Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

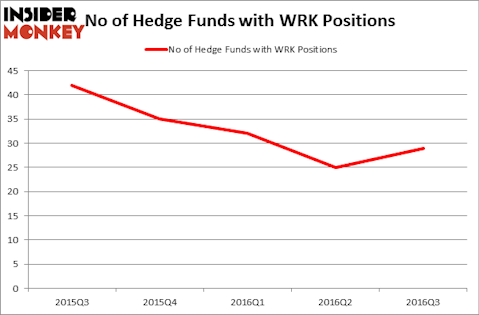

WestRock Co (NYSE:WRK) was in 29 hedge funds’ portfolios at the end of September. WRK shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. There were 25 hedge funds in our database with WRK positions at the end of the previous quarter. At the end of this article we will also compare WRK to other stocks including Mettler-Toledo International Inc. (NYSE:MTD), Total System Services, Inc. (NYSE:TSS), and CNH Industrial NV (NYSE:CNHI) to get a better sense of its popularity.

Follow Wrkco Inc. (NYSE:WRK)

Follow Wrkco Inc. (NYSE:WRK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: bialasiewicz / 123RF Stock Photo

What does the smart money think about WestRock Co (NYSE:WRK)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 16% rise from the second quarter of 2016. That followed three consecutive quarters of declining sentiment, so it appears that smart money is finally seeing something new to like in the company’s operations. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Starboard Value LP, managed by Jeffrey Smith, holds the number one position in WestRock Co (NYSE:WRK). Starboard Value LP has a $145.4 million position in the stock, comprising 4% of its 13F portfolio. Coming in second is Anthony Bozza of Lakewood Capital Management, with a $110.4 million position; the fund has 2.5% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions encompass Ken Griffin’s Citadel Investment Group, Israel Englander’s Millennium Management and Aaron Cowen’s Suvretta Capital Management.