We recently compiled a list of the 15 Best Lumber Stocks To Buy Now. In this article, we are going to take a look at where West Fraser Timber Co. Ltd. (NYSE:WFG) stands against the other lumber stocks.

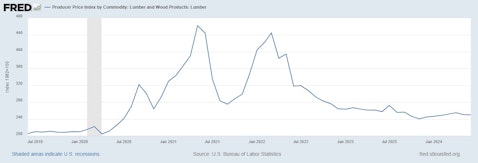

The lumber market has faced considerable volatility in recent years, driven by a confluence of dynamic and interconnected factors. In 2021, lumber prices surged to unprecedented levels due to the COVID-19 pandemic disrupting supply chains, a surge in home construction boosting demand, and logistical challenges further straining the market. However, this peak was followed by a dramatic price correction as these extraordinary conditions began to stabilize. Currently, lumber prices have plummeted 75% from their May 2021 record high of $1,514 per thousand board feet to just $366, closely matching pre-pandemic levels. The futures market has mirrored this decline, with contract prices for July falling 28% to $466. The following chart by U.S. Bureau of Labor Statistics clearly depicts the change in lumber prices over a five year horizon.

The sharp drop in lumber prices reflects a slowdown in both new home construction and renovations, largely due to high home prices and elevated mortgage rates that have reduced housing affordability. This has led to decreased demand for lumber, with a notable 52% year-over-year plunge in multi-family housing starts and a 2% decline in single-family starts as of May, reported by Fortune. Furthermore, the home renovation market, which had previously supported high lumber prices, is now also weakening. Retailers like Home Depot are seeing declines in sales, particularly for larger projects.

On the supply side, the lumber industry expanded production capacity during the boom years, expecting continued high demand. However, this new supply is now coming to market at a time when demand is low, exacerbating the oversupply situation. Experts predict that lumber prices may stagnate near current levels through the end of 2024, with a possible minor increase. Looking ahead to 2025, some sawmills might cut back production, and interest rate reductions could spur a modest recovery, potentially pushing prices between $500 and $600 per thousand board feet. Investors should be mindful of the ongoing volatility and regional price variations as they consider opportunities in the lumber market. For those looking to navigate the best lumber stocks to buy, the S&P Global Timber & Forestry (GTF) Index provides a valuable benchmark. Designed to measure the performance of companies involved in the ownership, management, or upstream supply chain of forests and timberlands, the index targets a constituent count of 100. This includes forest products companies, timber REITs, paper products firms, paper packaging companies, and agricultural businesses engaged in these sectors. As of August 1, 2024, the index has demonstrated a robust 10-year annualized return of 4.24%, currently valued at 2,012.10. This performance highlights the index’s stability and growth potential, making it a key consideration for investors in the timber and forestry sector.

According to the report from Timberland Investment Resources, investing in timberland presents several notable benefits and considerations. Timberland is a tangible asset that serves as a natural hedge against inflation. As inflation increases, the value of timberland often rises, helping to preserve purchasing power. This characteristic makes timberland an appealing option for investors seeking protection against inflationary pressures. Additionally, timberland offers substantial portfolio diversification due to its typically lower volatility compared to traditional equities. This reduced volatility can contribute to more stable long-term returns, making timberland an attractive choice for investors looking to balance risk and reward. Beyond capital appreciation, timberland investments can also generate a consistent income stream through timber harvesting. This dual benefit of income and appreciation makes timberland a valuable asset class for long-term investors.

The report also underscores the significance of sustainable management practices in timberland investments. Effective management is crucial for maintaining the health and productivity of forestlands while adhering to environmental standards and promoting ecological balance. Sustainable forestry practices, such as selective logging and reforestation, ensure that timberland remains productive and environmentally responsible over the long term. By implementing these practices, investors can mitigate negative environmental impacts and support the economic viability of their timberland assets. Sustainable management not only helps preserve the asset’s value but also aligns with growing environmental and regulatory expectations.

However, the report also identifies several risks associated with timberland investments. Timber prices can be highly variable, influenced by fluctuations in supply and demand, which can impact profitability. Additionally, timberland is vulnerable to natural disasters, such as wildfires, storms, and pest infestations, which can cause significant damage and affect returns. Regulatory changes and evolving environmental policies also pose risks, potentially impacting the operational aspects of timberland management. To effectively navigate these risks, the report emphasizes the importance of selecting well-managed timberland properties and partnering with experienced forestry professionals. Proper due diligence and active management are essential for mitigating these risks and maximizing the potential of timberland investments. Overall, while timberland offers stable growth and diversification benefits, it requires careful management and a long-term perspective to fully realize its potential.

The Food and Agriculture Organization (FAO) predicts a 37% increase in the consumption of primary processed wood products by 2050, according to their latest report. This growth includes materials such as sawnwood, plywood, and wood pulp, expected to reach 3.1 billion cubic meters. The rise is projected to be even higher, up to 23%, if modern wood products like mass timber and man-made cellulose fibers gain greater traction in replacing non-renewable materials. Wood’s renewable and versatile nature makes it a key player in efforts to replace non-renewable resources and address climate change. The FAO emphasizes the need for sustainable forest management and increased production from both naturally regenerated and planted forests to meet future demand. Investments totaling around $40 billion annually will be necessary to expand production, with an additional $25 billion for modernization. The sector might face challenges in maintaining employment levels and ensuring adequate training for a more sophisticated workforce. As demand for wood energy grows, especially in developing regions, balancing traditional fuelwood use with modern biomass energy will be crucial.

According to the National Association of Home Builders (NAHB), single-family home construction is expected to rise in 2024 despite ongoing supply-side challenges. Higher interest rates have impacted the housing market over the past two years, but with the Federal Reserve anticipated to lower rates in the latter half of 2024, mortgage rates are expected to decrease. This should stimulate homebuilding, although supply-side issues like rising prices and shortages of materials and labor will persist. The NAHB projects single-family starts to increase by 4.7% in 2024 and by 4.2% in 2025, but notes that this growth will not fully address the nation’s housing deficit of approximately 1.5 million units. Despite the forecasted increase in construction, the multifamily housing market faces challenges, with a 19.7% decline in multifamily starts anticipated for 2024 due to tight credit conditions. However, with a high volume of apartments currently under construction, rent growth is expected to slow, potentially easing inflation. Builders remain optimistic, with a majority planning to increase their activities, although they face hurdles including high regulatory costs and fluctuating land prices. The demand for housing continues to shift, with varying generational preferences influencing market dynamics. Addressing these challenges requires balancing new construction with sustainable practices and increased housing supply.

Our Methodology

We shortlisted the holdings of iShares Global Timber & Forestry ETF, ranked them by the number of hedge funds in each stock, and shared the 15 most popular timber and forestry stocks below. Basically our articles presents the best lumber and timber stocks to buy according to hedge funds.

A lumber mill with pristine forests in the background, showing the company’s commitment to renewable energy.

West Fraser Timber Co. Ltd. (NYSE:WFG)

Number of Hedge Fund Holders: 18

West Fraser Timber Co. Ltd. (NYSE:WFG), a diversified wood products company, manufactures and distributes lumber, engineered wood products, pulp, newsprint, and renewable energy. It markets its products to major retail chains, contractor supply yards, wholesalers, and industrial customers for further processing or as components for other goods across Canada, the United States, the United Kingdom, Europe, and globally. Established in 1955, the company is headquartered in Vancouver, Canada. On July 29, CIBC analyst Hamir Patel raised the firm’s price target for West Fraser Timber Co. Ltd. (NYSE:WFG) to C$138 from C$125, while maintaining an Outperform rating, reflecting confidence in the company’s future performance. In the latest quarter, announced on July 24, West Fraser Timber Co. Ltd. (NYSE:WFG) reported a normalized EPS of $1.34, surpassing estimates by $0.18. The company also beat revenue estimates with $1.70 billion, surpassing forecasts by $124.06 million. The company offers a forward dividend yield of 1.44% with an annual payout of $1.28 and a payout ratio of 49.94%. The dividend has grown at an impressive 16.66% over the past five years and has been increasing for three years. This indicates a stable return for investors and a strong commitment to rewarding shareholders.

In the first quarter of 2024, the number of hedge funds with stakes in West Fraser Timber Co. Ltd. (NYSE:WFG) increased to 18 from 16 in the previous quarter, according to Insider Monkey’s database. The combined value of these stakes is approximately $138.42 million. Israel Englander’s Millennium Management emerged as the largest stakeholder among these hedge funds during this period.

Overall WFG ranks 8th on our list of the best lumber stocks to buy. While we acknowledge the potential of WFG as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than WFG but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. This article is originally published at Insider Monkey.