Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Wells Fargo & Company (NYSE:WFC) changed recently.

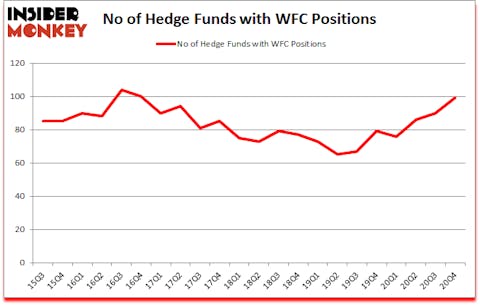

Is Wells Fargo (WFC) stock a buy or sell? Hedge funds were becoming hopeful. The number of bullish hedge fund bets improved by 9 in recent months. Wells Fargo & Company (NYSE:WFC) was in 99 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 104. Our calculations also showed that WFC ranked 23rd among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 90 hedge funds in our database with WFC holdings at the end of September.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017 (see the details here).

Richard S. Pzena of Pzena Investment Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). With all of this in mind let’s take a glance at the new hedge fund action encompassing Wells Fargo & Company (NYSE:WFC).

Do Hedge Funds Think WFC Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 99 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in WFC over the last 22 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Warren Buffett’s Berkshire Hathaway has the biggest position in Wells Fargo & Company (NYSE:WFC), worth close to $1.5822 billion, amounting to 0.6% of its total 13F portfolio. The second largest stake is held by Boykin Curry of Eagle Capital Management, with a $1.3856 billion position; 4.4% of its 13F portfolio is allocated to the stock. Other peers with similar optimism contain D. E. Shaw’s D E Shaw, Richard S. Pzena’s Pzena Investment Management and Patrick Degorce’s Theleme Partners. In terms of the portfolio weights assigned to each position Magnolia Capital Fund allocated the biggest weight to Wells Fargo & Company (NYSE:WFC), around 21.85% of its 13F portfolio. Theleme Partners is also relatively very bullish on the stock, dishing out 19.84 percent of its 13F equity portfolio to WFC.

There weren’t any hedge funds initiating brand new positions in the stock during the fourth quarter.

Let’s also examine hedge fund activity in other stocks similar to Wells Fargo & Company (NYSE:WFC). We will take a look at Morgan Stanley (NYSE:MS), Sanofi (NYSE:SNY), The Boeing Company (NYSE:BA), Lowe’s Companies, Inc. (NYSE:LOW), China Mobile Limited (NYSE:CHL), Royal Bank of Canada (NYSE:RY), and International Business Machines Corp. (NYSE:IBM). This group of stocks’ market valuations are similar to WFC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MS | 66 | 5665191 | -4 |

| SNY | 15 | 1145189 | -5 |

| BA | 55 | 1057323 | 12 |

| LOW | 71 | 5192115 | -12 |

| CHL | 13 | 275668 | 3 |

| RY | 18 | 177204 | 2 |

| IBM | 51 | 998446 | 11 |

| Average | 41.3 | 2073019 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.3 hedge funds with bullish positions and the average amount invested in these stocks was $2073 million. That figure was $8749 million in WFC’s case. Lowe’s Companies, Inc. (NYSE:LOW) is the most popular stock in this table. On the other hand China Mobile Limited (NYSE:CHL) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Wells Fargo & Company (NYSE:WFC) is more popular among hedge funds. Our overall hedge fund sentiment score for WFC is 88.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 5.3% in 2021 through March 19th but still managed to beat the market by 0.8 percentage points. Hedge funds were also right about betting on WFC as the stock returned 31.7% since the end of December (through 3/19) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Wells Fargo & Company (NYSE:WFC)

Follow Wells Fargo & Company (NYSE:WFC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.