Is Wal-Mart Stores, Inc. (NYSE:WMT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

Is Wal-Mart Stores, Inc. (NYSE:WMT) a buy right now? Money managers are taking a bullish view. The number of bullish hedge fund bets inched up by 13 lately. At the end of this article we will also compare WMT to other stocks including JPMorgan Chase & Co. (NYSE:JPM), The Procter & Gamble Company (NYSE:PG), and Pfizer Inc. (NYSE:PFE) to get a better sense of its popularity.

Follow Walmart Inc. (NYSE:WMT)

Follow Walmart Inc. (NYSE:WMT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Niloo / Shutterstock.com

With all of this in mind, let’s take a peek at the recent action regarding Wal-Mart Stores, Inc. (NYSE:WMT).

What have hedge funds been doing with Wal-Mart Stores, Inc. (NYSE:WMT)?

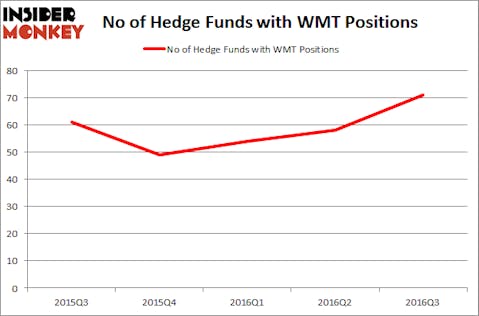

At Q3’s end, a total of 71 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the second quarter of 2016. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Berkshire Hathaway, managed by Warren Buffett, holds the largest position in Wal-Mart Stores, Inc. (NYSE:WMT). Berkshire Hathaway has a $935.5 million position in the stock, comprising 0.7% of its 13F portfolio. The second largest stake is held by Bill & Melinda Gates Foundation Trust, managed by Michael Larson, which holds a $836.8 million position; 4.5% of its 13F portfolio is allocated to the company. Other professional money managers with similar optimism consist of Cliff Asness’ AQR Capital Management, D. E. Shaw’s D E Shaw and Richard S. Pzena’s Pzena Investment Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, created the biggest position in Wal-Mart Stores, Inc. (NYSE:WMT). Two Sigma Advisors had $237.2 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $70 million investment in the stock during the quarter. The other funds with new positions in the stock are Gregg Moskowitz’s Interval Partners, Benjamin A. Smith’s Laurion Capital Management, and Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Wal-Mart Stores, Inc. (NYSE:WMT) but similarly valued. These stocks are JPMorgan Chase & Co. (NYSE:JPM), The Procter & Gamble Company (NYSE:PG), Pfizer Inc. (NYSE:PFE), and Anheuser-Busch InBev NV (ADR) (NYSE:BUD). This group of stocks’ market caps are similar to WMT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JPM | 98 | 7608932 | -1 |

| PG | 71 | 20098044 | 15 |

| PFE | 83 | 5499374 | -11 |

| BUD | 32 | 5851359 | -3 |

As you can see these stocks had an average of 71 hedge funds with bullish positions and the average amount invested in these stocks was $9.76 billion. That figure was $5.46 billion in WMT’s case. JPMorgan Chase & Co. (NYSE:JPM) is the most popular stock in this table. On the other hand Anheuser-Busch InBev NV (ADR) (NYSE:BUD) is the least popular one with only 32 bullish hedge fund positions. Wal-Mart Stores, Inc. (NYSE:WMT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard JPM might be a better candidate to consider a long position.