Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Waitr Holdings Inc. (NASDAQ:WTRH) based on that data.

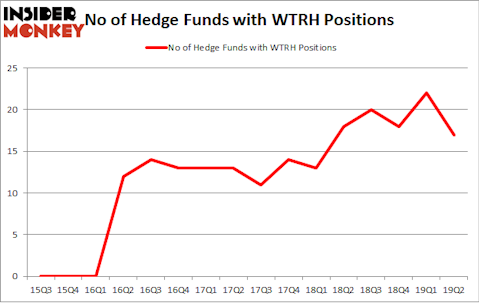

Waitr Holdings Inc. (NASDAQ:WTRH) was in 17 hedge funds’ portfolios at the end of the second quarter of 2019. WTRH has seen a decrease in hedge fund interest in recent months. There were 22 hedge funds in our database with WTRH positions at the end of the previous quarter. Our calculations also showed that WTRH isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the key hedge fund action surrounding Waitr Holdings Inc. (NASDAQ:WTRH).

What does smart money think about Waitr Holdings Inc. (NASDAQ:WTRH)?

At Q2’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WTRH over the last 16 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Park West Asset Management, managed by Peter S. Park, holds the number one position in Waitr Holdings Inc. (NASDAQ:WTRH). Park West Asset Management has a $28.4 million position in the stock, comprising 1.2% of its 13F portfolio. The second largest stake is held by Pelham Capital, led by Ross Turner, holding a $27.7 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Other professional money managers that are bullish consist of Ian Cumming and Joseph Steinberg’s Leucadia National, Keith Meister’s Corvex Capital and Mark Moore’s ThornTree Capital Partners.

Because Waitr Holdings Inc. (NASDAQ:WTRH) has experienced a decline in interest from hedge fund managers, logic holds that there is a sect of funds that slashed their full holdings heading into Q3. It’s worth mentioning that Christian Leone’s Luxor Capital Group cut the largest investment of the “upper crust” of funds watched by Insider Monkey, comprising close to $10.3 million in stock, and Richard Driehaus’s Driehaus Capital was right behind this move, as the fund said goodbye to about $5.2 million worth. These transactions are important to note, as total hedge fund interest dropped by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Waitr Holdings Inc. (NASDAQ:WTRH) but similarly valued. We will take a look at Barnes & Noble, Inc. (NYSE:BKS), First Financial Corporation (NASDAQ:THFF), ObsEva SA (NASDAQ:OBSV), and Changyou.Com Limited (NASDAQ:CYOU). This group of stocks’ market caps are similar to WTRH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BKS | 12 | 40157 | -6 |

| THFF | 9 | 14616 | 2 |

| OBSV | 8 | 64275 | -3 |

| CYOU | 9 | 29815 | -2 |

| Average | 9.5 | 37216 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $135 million in WTRH’s case. Barnes & Noble, Inc. (NYSE:BKS) is the most popular stock in this table. On the other hand ObsEva SA (NASDAQ:OBSV) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Waitr Holdings Inc. (NASDAQ:WTRH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WTRH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WTRH were disappointed as the stock returned -79.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.