With the third-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the fourth quarter. One of these stocks was W.R. Grace & Co. (NYSE:GRA).

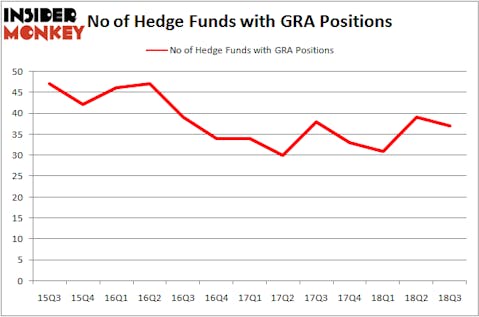

Is W.R. Grace & Co. (NYSE:GRA) worth your attention right now? Investors who are in the know are taking a bearish view. The number of long hedge fund positions dropped by 2 recently. Our calculations also showed that GRA isn’t among the 30 most popular stocks among hedge funds. GRA was in 37 hedge funds’ portfolios at the end of September. There were 39 hedge funds in our database with GRA positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to the beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the new hedge fund action surrounding W.R. Grace & Co. (NYSE:GRA).

What have hedge funds been doing with W.R. Grace & Co. (NYSE:GRA)?

Heading into the fourth quarter of 2018, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the second quarter of 2018. By comparison, 33 hedge funds held shares or bullish call options in GRA heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, David S. Winter and David J. Millstone’s 40 North Management has the number one position in W.R. Grace & Co. (NYSE:GRA), worth close to $476.1 million, corresponding to 54.9% of its total 13F portfolio. On 40 North Management’s heels is Soroban Capital Partners, led by Eric W. Mandelblatt and Gaurav Kapadia, holding a $225.6 million position; 3.4% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions include David Cohen and Harold Levy’s Iridian Asset Management, Jeffrey Gates’s Gates Capital Management and D. E. Shaw’s D E Shaw.

Due to the fact that W.R. Grace & Co. (NYSE:GRA) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedgies who sold off their full holdings by the end of the third quarter. At the top of the heap, John Overdeck and David Siegel’s Two Sigma Advisors cut the largest position of the “upper crust” of funds watched by Insider Monkey, worth an estimated $37.9 million in call options. Dmitry Balyasny’s fund, Balyasny Asset Management, also dumped its call options, about $13.4 million worth. These transactions are important to note, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to W.R. Grace & Co. (NYSE:GRA). We will take a look at Weight Watchers International, Inc. (NYSE:WTW), Shell Midstream Partners LP (NYSE:SHLX), Wintrust Financial Corporation (NASDAQ:WTFC), and Air Lease Corp (NYSE:AL). This group of stocks’ market caps are closest to GRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WTW | 31 | 341742 | 3 |

| SHLX | 6 | 23953 | -1 |

| WTFC | 24 | 509242 | 7 |

| AL | 27 | 427583 | 3 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $326 million. That figure was $1635 million in GRA’s case. Weight Watchers International, Inc. (NYSE:WTW) is the most popular stock in this table. On the other hand Shell Midstream Partners LP (NYSE:SHLX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks W.R. Grace & Co. (NYSE:GRA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.