Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in VMware, Inc. (NYSE:VMW)? The smart money sentiment can provide an answer to this question.

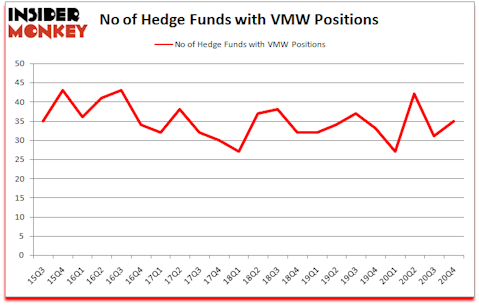

Is VMW stock a buy? VMware, Inc. (NYSE:VMW) was in 35 hedge funds’ portfolios at the end of December. The all time high for this statistic is 43. VMW has experienced an increase in hedge fund interest recently. There were 31 hedge funds in our database with VMW positions at the end of the third quarter. Our calculations also showed that VMW isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

At the moment there are tons of metrics stock traders put to use to analyze their stock investments. A couple of the most useful metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the best money managers can outpace the S&P 500 by a superb amount (see the details here).

Thomas Claugus of GMT Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s review the key hedge fund action regarding VMware, Inc. (NYSE:VMW).

Do Hedge Funds Think VMW Is A Good Stock To Buy Now?

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the third quarter of 2020. By comparison, 33 hedge funds held shares or bullish call options in VMW a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John Overdeck and David Siegel’s Two Sigma Advisors has the number one position in VMware, Inc. (NYSE:VMW), worth close to $122.5 million, accounting for 0.3% of its total 13F portfolio. Sitting at the No. 2 spot is Jacob Mitchell of Antipodes Partners, with a $91.3 million position; the fund has 4% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Thomas E. Claugus’s GMT Capital, Ken Griffin’s Citadel Investment Group and Renaissance Technologies. In terms of the portfolio weights assigned to each position GMT Capital allocated the biggest weight to VMware, Inc. (NYSE:VMW), around 4.82% of its 13F portfolio. Antipodes Partners is also relatively very bullish on the stock, earmarking 3.97 percent of its 13F equity portfolio to VMW.

As industrywide interest jumped, specific money managers have been driving this bullishness. Millennium Management, managed by Israel Englander, initiated the most outsized position in VMware, Inc. (NYSE:VMW). Millennium Management had $6.9 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $4 million position during the quarter. The following funds were also among the new VMW investors: Will Graves’s Boardman Bay Capital Management, Jinghua Yan’s TwinBeech Capital, and Qing Li’s Sciencast Management.

Let’s check out hedge fund activity in other stocks similar to VMware, Inc. (NYSE:VMW). We will take a look at Atlassian Corporation Plc (NASDAQ:TEAM), The Progressive Corporation (NYSE:PGR), Ferrari N.V. (NYSE:RACE), ABB Ltd (NYSE:ABB), Workday Inc (NASDAQ:WDAY), Takeda Pharmaceutical Company Limited (NYSE:TAK), and Edwards Lifesciences Corporation (NYSE:EW). This group of stocks’ market caps are similar to VMW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TEAM | 69 | 4932963 | 21 |

| PGR | 48 | 1744884 | 1 |

| RACE | 29 | 1527088 | -2 |

| ABB | 8 | 467566 | -5 |

| WDAY | 80 | 4443166 | 6 |

| TAK | 18 | 835529 | -1 |

| EW | 38 | 1243466 | -8 |

| Average | 41.4 | 2170666 | 1.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.4 hedge funds with bullish positions and the average amount invested in these stocks was $2171 million. That figure was $406 million in VMW’s case. Workday Inc (NASDAQ:WDAY) is the most popular stock in this table. On the other hand ABB Ltd (NYSE:ABB) is the least popular one with only 8 bullish hedge fund positions. VMware, Inc. (NYSE:VMW) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for VMW is 52.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7.9% in 2021 through April 1st and still beat the market by 0.4 percentage points. A small number of hedge funds were also right about betting on VMW as the stock returned 8.7% since the end of the fourth quarter (through 4/1) and outperformed the market by an even larger margin.

Follow Vmware Llc (NYSE:VMW)

Follow Vmware Llc (NYSE:VMW)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.