The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Visteon Corp (NYSE:VC), and what that likely means for the prospects of the company and its stock.

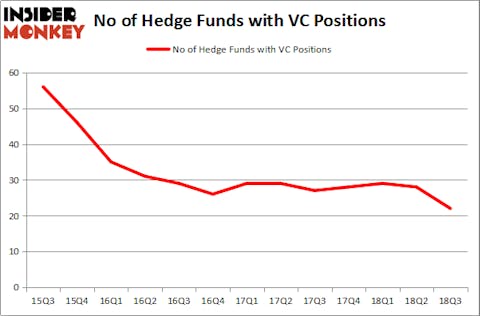

Visteon Corp (NYSE:VC) has experienced a decrease in enthusiasm from smart money recently. The company was in 22 hedge funds’ portfolios at the end of the third quarter of 2018, down from 28 hedge funds at the end of the previous quarter. With 22 shareholder in Insider Monkey’s database, Visteon Corp wasn’t even close to be considered as one of the 30 most popular stocks among hedge funds in Q3 of 2018.

“Visteon Corporation, which supplies electronic components to automakers, reported lower-than-expected earnings in the second quarter and reduced its guidance due to weakness in both the North American and European automobile markets. The stock also reacted to trade concerns and negative trends in Chinese auto sales.” – as reported in First Eagle Fund of America’s Q3 Commentary.

At the moment there are many metrics shareholders have at their disposal to size up their stock investments. Some of the less utilized metrics are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can trounce the broader indices by a healthy amount (see the details here).

Let’s analyze the latest hedge fund action regarding Visteon Corp (NYSE:VC).

How are hedge funds trading Visteon Corp (NYSE:VC)?

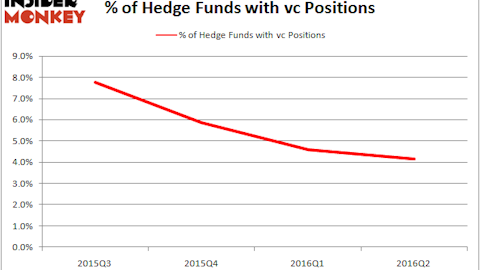

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 21% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in VC over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Visteon Corp (NYSE:VC) was held by Iridian Asset Management, which reported holding $210.9 million worth of stock at the end of September. It was followed by AQR Capital Management with a $35.5 million position. Other investors bullish on the company included Private Capital Management, Point72 Asset Management, and GAMCO Investors.

Due to the fact that Visteon Corp (NYSE:VC) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there exists a select few money managers who were dropping their positions entirely last quarter. Intriguingly, Israel Englander’s Millennium Management dropped the largest position of the 700 funds monitored by Insider Monkey, totaling an estimated $23.8 million in stock. Robert B. Gillam’s fund, McKinley Capital Management, also said goodbye to its stock, about $14.2 million worth. These moves are important to note, as total hedge fund interest dropped by 6 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Visteon Corp (NYSE:VC) but similarly valued. We will take a look at argenx SE (NASDAQ:ARGX), DSW Inc. (NYSE:DSW), First Interstate Bancsystem Inc (NASDAQ:FIBK), and Oceaneering International, Inc. (NYSE:OII). This group of stocks’ market caps match VC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARGX | 34 | 612491 | 11 |

| DSW | 27 | 277884 | 4 |

| FIBK | 12 | 64678 | 1 |

| OII | 12 | 226349 | -5 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $295 million. That figure was $354 million in VC’s case. argenx SE (NASDAQ:ARGX) is the most popular stock in this table. On the other hand First Interstate Bancsystem Inc (NASDAQ:FIBK) is the least popular one with only 12 bullish hedge fund positions. Visteon Corp (NYSE:VC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ARGX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.