As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Vicor Corp (NASDAQ:VICR).

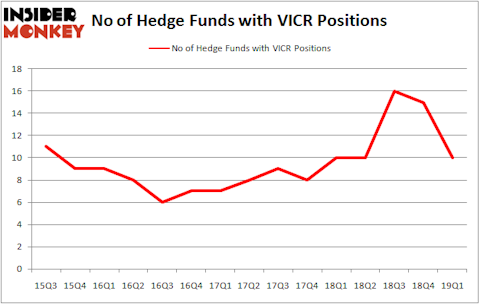

Vicor Corp (NASDAQ:VICR) investors should pay attention to a decrease in support from the world’s most elite money managers recently. VICR was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. There were 15 hedge funds in our database with VICR positions at the end of the previous quarter. Our calculations also showed that VICR isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are seen as underperforming, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading at present, Our researchers hone in on the masters of this club, about 750 funds. These investment experts administer the lion’s share of the smart money’s total asset base, and by observing their unrivaled investments, Insider Monkey has figured out a few investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Glenn Russell Dubin of Highbridge Capital

Let’s take a glance at the key hedge fund action regarding Vicor Corp (NASDAQ:VICR).

Hedge fund activity in Vicor Corp (NASDAQ:VICR)

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards VICR over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Vicor Corp (NASDAQ:VICR) was held by Highbridge Capital Management, which reported holding $5.7 million worth of stock at the end of March. It was followed by AQR Capital Management with a $4.8 million position. Other investors bullish on the company included Trellus Management Company, Manatuck Hill Partners, and Citadel Investment Group.

Because Vicor Corp (NASDAQ:VICR) has faced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers that elected to cut their positions entirely last quarter. It’s worth mentioning that Alok Agrawal’s Bloom Tree Partners dumped the largest position of the 700 funds followed by Insider Monkey, totaling about $30.2 million in stock. Jim Simons’s fund, Renaissance Technologies, also cut its stock, about $1.3 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Vicor Corp (NASDAQ:VICR) but similarly valued. These stocks are SRC Energy Inc. (NYSE:SRCI), Tupperware Brands Corporation (NYSE:TUP), First Commonwealth Financial Corporation (NYSE:FCF), and Gentherm Inc (NASDAQ:THRM). All of these stocks’ market caps are similar to VICR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRCI | 14 | 318271 | 0 |

| TUP | 23 | 170838 | 1 |

| FCF | 15 | 40578 | 2 |

| THRM | 19 | 75339 | 2 |

| Average | 17.75 | 151257 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $151 million. That figure was $24 million in VICR’s case. Tupperware Brands Corporation (NYSE:TUP) is the most popular stock in this table. On the other hand SRC Energy Inc. (NYSE:SRCI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Vicor Corp (NASDAQ:VICR) is even less popular than SRCI. Hedge funds dodged a bullet by taking a bearish stance towards VICR. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately VICR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); VICR investors were disappointed as the stock returned -4.4% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.