With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was Verona Pharma plc (NASDAQ:VRNA).

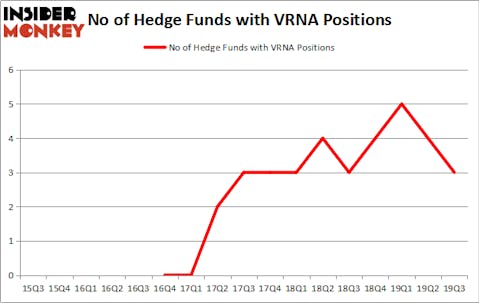

Is Verona Pharma plc (NASDAQ:VRNA) an exceptional investment now? The smart money is turning less bullish. The number of bullish hedge fund positions decreased by 1 in recent months. Our calculations also showed that VRNA isn’t among the 30 most popular stocks among hedge funds. VRNA was in 3 hedge funds’ portfolios at the end of September. There were 4 hedge funds in our database with VRNA holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Samuel Isaly of OrbiMed Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the latest hedge fund action regarding Verona Pharma plc (NASDAQ:VRNA).

How have hedgies been trading Verona Pharma plc (NASDAQ:VRNA)?

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from one quarter earlier. By comparison, 3 hedge funds held shares or bullish call options in VRNA a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Verona Pharma plc (NASDAQ:VRNA) was held by Vivo Capital, which reported holding $6.8 million worth of stock at the end of September. It was followed by OrbiMed Advisors with a $5.7 million position. The only other hedge fund that is bullish on the company was Polar Capital.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Renaissance Technologies. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified VRNA as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks similar to Verona Pharma plc (NASDAQ:VRNA). We will take a look at Patriot Transportation Holding Inc (NASDAQ:PATI), Merrimack Pharmaceuticals Inc (NASDAQ:MACK), Greenland Acquisition Corporation (NASDAQ:GLAC), and Zovio Inc. (NASDAQ:ZVO). This group of stocks’ market values are similar to VRNA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PATI | 3 | 8659 | 0 |

| MACK | 4 | 8753 | -1 |

| GLAC | 6 | 6869 | 0 |

| ZVO | 13 | 15399 | 3 |

| Average | 6.5 | 9920 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $13 million in VRNA’s case. Zovio Inc. (NASDAQ:ZVO) is the most popular stock in this table. On the other hand Patriot Transportation Holding Inc (NASDAQ:PATI) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Verona Pharma plc (NASDAQ:VRNA) is even less popular than PATI. Hedge funds dodged a bullet by taking a bearish stance towards VRNA. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately VRNA wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); VRNA investors were disappointed as the stock returned -16.8% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.