Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. After several tireless days we have finished crunching the numbers from nearly 835 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31st. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Verisk Analytics, Inc. (NASDAQ:VRSK).

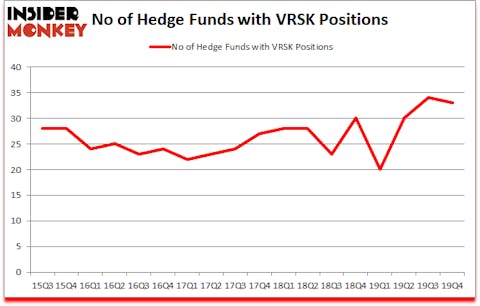

Is Verisk Analytics, Inc. (NASDAQ:VRSK) undervalued? Investors who are in the know are taking a pessimistic view. The number of long hedge fund positions were cut by 1 in recent months. Our calculations also showed that VRSK isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). VRSK was in 33 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 34 hedge funds in our database with VRSK holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most shareholders, hedge funds are seen as slow, outdated financial vehicles of yesteryear. While there are more than 8000 funds trading at the moment, We choose to focus on the leaders of this club, around 850 funds. These investment experts preside over bulk of the hedge fund industry’s total asset base, and by paying attention to their highest performing investments, Insider Monkey has found several investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Dmitry Balyasny of Balyasny Asset Managemnet

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a peek at the fresh hedge fund action regarding Verisk Analytics, Inc. (NASDAQ:VRSK).

Hedge fund activity in Verisk Analytics, Inc. (NASDAQ:VRSK)

Heading into the first quarter of 2020, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards VRSK over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Charles Akre’s Akre Capital Management has the most valuable position in Verisk Analytics, Inc. (NASDAQ:VRSK), worth close to $379.9 million, amounting to 3.5% of its total 13F portfolio. On Akre Capital Management’s heels is Nicolai Tangen of Ako Capital, with a $145.5 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Dmitry Balyasny’s Balyasny Asset Management, Greg Poole’s Echo Street Capital Management and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Blue Whale Capital allocated the biggest weight to Verisk Analytics, Inc. (NASDAQ:VRSK), around 3.76% of its 13F portfolio. Akre Capital Management is also relatively very bullish on the stock, designating 3.48 percent of its 13F equity portfolio to VRSK.

Since Verisk Analytics, Inc. (NASDAQ:VRSK) has witnessed bearish sentiment from the smart money, logic holds that there were a few fund managers who sold off their full holdings by the end of the third quarter. It’s worth mentioning that Nicolai Tangen’s Ako Capital dumped the biggest investment of the “upper crust” of funds followed by Insider Monkey, valued at about $147.5 million in stock. James Parsons’s fund, Junto Capital Management, also said goodbye to its stock, about $28.6 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Verisk Analytics, Inc. (NASDAQ:VRSK). These stocks are Aptiv PLC (NYSE:APTV), Telefonica Brasil SA (NYSE:VIV), Hormel Foods Corporation (NYSE:HRL), and Realty Income Corporation (NYSE:O). All of these stocks’ market caps match VRSK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APTV | 46 | 1053189 | 17 |

| VIV | 12 | 97729 | -1 |

| HRL | 23 | 240372 | 1 |

| O | 26 | 394173 | 8 |

| Average | 26.75 | 446366 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $446 million. That figure was $849 million in VRSK’s case. Aptiv PLC (NYSE:APTV) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 12 bullish hedge fund positions. Verisk Analytics, Inc. (NASDAQ:VRSK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but still beat the market by 3.1 percentage points. Hedge funds were also right about betting on VRSK as the stock returned 1.6% during the first quarter (through March 11th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.