Is USANA Health Sciences, Inc. (NYSE:USNA) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

USANA Health Sciences, Inc. (NYSE:USNA) investors should be aware of a decrease in support from the world’s most elite money managers recently. Our calculations also showed that USNA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are viewed as unimportant, old financial vehicles of yesteryear. While there are over 8000 funds in operation today, Our researchers hone in on the upper echelon of this group, around 750 funds. Most estimates calculate that this group of people shepherd bulk of the smart money’s total asset base, and by watching their highest performing investments, Insider Monkey has spotted several investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December we recommended Adams Energy based on an under-the-radar fund manager’s investor letter and the stock gained 20 percent. Let’s take a peek at the new hedge fund action surrounding USANA Health Sciences, Inc. (NYSE:USNA).

How have hedgies been trading USANA Health Sciences, Inc. (NYSE:USNA)?

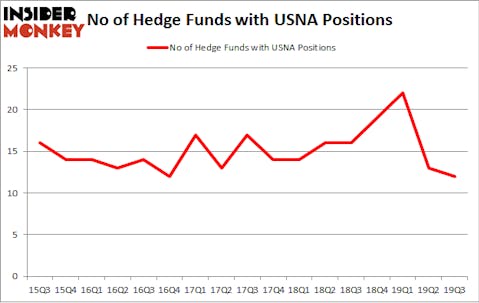

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in USNA over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies has the most valuable position in USANA Health Sciences, Inc. (NYSE:USNA), worth close to $113.5 million, comprising 0.1% of its total 13F portfolio. The second largest stake is held by David E. Shaw of D E Shaw, with a $23.4 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other professional money managers that are bullish encompass Cliff Asness’s AQR Capital Management, Noam Gottesman’s GLG Partners and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Quantinno Capital allocated the biggest weight to USANA Health Sciences, Inc. (NYSE:USNA), around 0.17% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, earmarking 0.1 percent of its 13F equity portfolio to USNA.

Due to the fact that USANA Health Sciences, Inc. (NYSE:USNA) has faced bearish sentiment from the smart money, we can see that there exists a select few money managers who sold off their positions entirely in the third quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the largest stake of the 750 funds monitored by Insider Monkey, worth close to $16.5 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $9.6 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as USANA Health Sciences, Inc. (NYSE:USNA) but similarly valued. We will take a look at HNI Corporation (NYSE:HNI), Tricida, Inc. (NASDAQ:TCDA), Magellan Health Inc (NASDAQ:MGLN), and Harsco Corporation (NYSE:HSC). All of these stocks’ market caps match USNA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HNI | 16 | 79013 | 2 |

| TCDA | 17 | 702923 | 0 |

| MGLN | 17 | 284049 | -2 |

| HSC | 18 | 181922 | 0 |

| Average | 17 | 311977 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $312 million. That figure was $170 million in USNA’s case. Harsco Corporation (NYSE:HSC) is the most popular stock in this table. On the other hand HNI Corporation (NYSE:HNI) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks USANA Health Sciences, Inc. (NYSE:USNA) is even less popular than HNI. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on USNA, though not to the same extent, as the stock returned 7.6% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.