Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

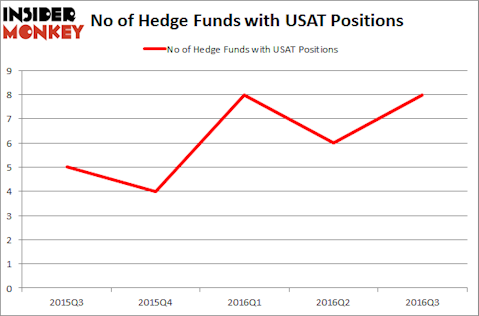

Is USA Technologies, Inc. (NASDAQ:USAT) a buy here? The smart money is buying. The number of bullish hedge fund bets swelled by 2 lately. There were 8 hedge funds in our database with USAT positions at the end of September. At the end of this article we will also compare USAT to other stocks including Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), Equity BancShares Inc (NASDAQ:EQBK), and MCBC Holdings Inc (NASDAQ:MCFT) to get a better sense of its popularity.

Follow Cantaloupe Inc. (NASDAQ:CTLP)

Follow Cantaloupe Inc. (NASDAQ:CTLP)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Andresr/Shutterstock.com

With all of this in mind, let’s analyze the recent action surrounding USA Technologies, Inc. (NASDAQ:USAT).

How are hedge funds trading USA Technologies, Inc. (NASDAQ:USAT)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. On the other hand, there were a total of 4 hedge funds with a bullish position in USAT at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the number one position in USA Technologies, Inc. (NASDAQ:USAT). Renaissance Technologies has a $1.5 million position in the stock, comprising less than 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is Driehaus Capital, led by Richard Driehaus, holding a $1.2 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Josh Goldberg’s G2 Investment Partners Management, and Glenn Russell Dubin’s Highbridge Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.