Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at United Rentals, Inc. (NYSE:URI) from the perspective of those elite funds.

United Rentals, Inc. (NYSE:URI) shareholders have witnessed an increase in hedge fund sentiment recently. At the end of this article we will also compare URI to other stocks including STERIS Corp (NYSE:STE), Michaels Companies Inc (NASDAQ:MIK), and Flowserve Corporation (NYSE:FLS) to get a better sense of its popularity.

Follow United Rentals Inc. (NYSE:URI)

Follow United Rentals Inc. (NYSE:URI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

Keeping this in mind, let’s review the new action encompassing United Rentals, Inc. (NYSE:URI).

How have hedgies been trading United Rentals, Inc. (NYSE:URI)?

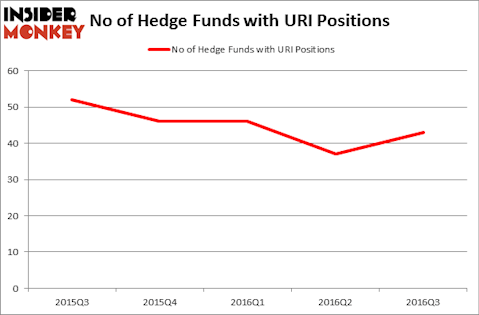

At Q3’s end, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from the previous quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Richard McGuire’s Marcato Capital Management has the most valuable position in United Rentals, Inc. (NYSE:URI), worth close to $82.7 million, amounting to 7.1% of its total 13F portfolio. Coming in second is Stelliam Investment Management, led by Ross Margolies, holding a $43.8 million position; the fund has 1.5% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Dmitry Balyasny’s Balyasny Asset Management.