We can judge whether United Parcel Service, Inc. (NYSE:UPS) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

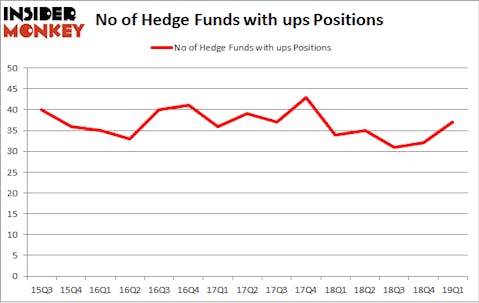

Is United Parcel Service, Inc. (NYSE:UPS) a healthy stock for your portfolio? Hedge funds are betting on the stock. The number of bullish hedge fund bets moved up by 5 lately. Our calculations also showed that ups isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the key hedge fund action surrounding United Parcel Service, Inc. (NYSE:UPS).

Hedge fund activity in United Parcel Service, Inc. (NYSE:UPS)

At the end of the first quarter, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from one quarter earlier. On the other hand, there were a total of 34 hedge funds with a bullish position in UPS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Bill & Melinda Gates Foundation Trust held the most valuable stake in United Parcel Service, Inc. (NYSE:UPS), which was worth $505.7 million at the end of the first quarter. On the second spot was Citadel Investment Group which amassed $216.7 million worth of shares. Moreover, Two Sigma Advisors, Adage Capital Management, and Southpoint Capital Advisors were also bullish on United Parcel Service, Inc. (NYSE:UPS), allocating a large percentage of their portfolios to this stock.

Now, some big names were leading the bulls’ herd. Holocene Advisors, managed by Brandon Haley, created the largest call position in United Parcel Service, Inc. (NYSE:UPS). Holocene Advisors had $47.2 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also made a $44.7 million investment in the stock during the quarter. The following funds were also among the new UPS investors: Alexander Mitchell’s Scopus Asset Management, Mike Masters’s Masters Capital Management, and Gregg Moskowitz’s Interval Partners.

Let’s check out hedge fund activity in other stocks similar to United Parcel Service, Inc. (NYSE:UPS). These stocks are Linde plc (NYSE:LIN), British American Tobacco plc (NYSE:BTI), Danaher Corporation (NYSE:DHR), and Starbucks Corporation (NASDAQ:SBUX). This group of stocks’ market valuations match UPS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LIN | 37 | 1629340 | 0 |

| BTI | 15 | 316057 | 5 |

| DHR | 58 | 3081018 | 10 |

| SBUX | 47 | 4588018 | 5 |

| Average | 39.25 | 2403608 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $2404 million. That figure was $1007 million in UPS’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSE:BTI) is the least popular one with only 15 bullish hedge fund positions. United Parcel Service, Inc. (NYSE:UPS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately UPS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); UPS investors were disappointed as the stock returned -13.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.