Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Two Harbors Investment Corp (NYSE:TWO).

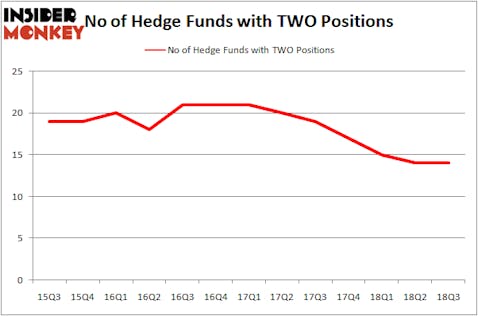

Hedge fund interest in Two Harbors Investment Corp (NYSE:TWO) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Americold Realty Trust (NYSE:COLD), Black Stone Minerals LP (NYSE:BSM), and Ensco plc (NYSE:ESV) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action encompassing Two Harbors Investment Corp (NYSE:TWO).

What have hedge funds been doing with Two Harbors Investment Corp (NYSE:TWO)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, representing no change from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in TWO heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Two Harbors Investment Corp (NYSE:TWO), which was worth $80.1 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $25.2 million worth of shares. Moreover, Millennium Management, PEAK6 Capital Management, and HBK Investments were also bullish on Two Harbors Investment Corp (NYSE:TWO), allocating a large percentage of their portfolios to this stock.

Due to the fact that Two Harbors Investment Corp (NYSE:TWO) has faced declining sentiment from the smart money, it’s safe to say that there lies a certain “tier” of funds that elected to cut their positions entirely last quarter. Intriguingly, Paul Tudor Jones’s Tudor Investment Corp dumped the largest position of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $1.1 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also dropped its stock, about $0.9 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Two Harbors Investment Corp (NYSE:TWO). We will take a look at Americold Realty Trust (NYSE:COLD), Black Stone Minerals LP (NYSE:BSM), Ensco plc (NYSE:ESV), and Manchester United PLC (NYSE:MANU). All of these stocks’ market caps are similar to TWO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLD | 21 | 542260 | 11 |

| BSM | 5 | 19218 | -2 |

| ESV | 29 | 677112 | 2 |

| MANU | 8 | 95726 | 0 |

| Average | 15.75 | 333579 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $334 million. That figure was $122 million in TWO’s case. Ensco plc (NYSE:ESV) is the most popular stock in this table. On the other hand Black Stone Minerals LP (NYSE:BSM) is the least popular one with only 5 bullish hedge fund positions. Two Harbors Investment Corp (NYSE:TWO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ESV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.