How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Take-Two Interactive Software, Inc. (NASDAQ:TTWO).

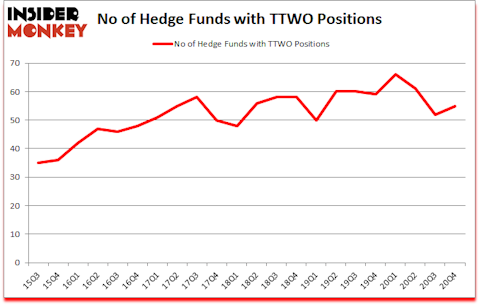

Is TTWO stock a buy or sell? Take-Two Interactive Software, Inc. (NASDAQ:TTWO) investors should pay attention to an increase in enthusiasm from smart money of late. Take-Two Interactive Software, Inc. (NASDAQ:TTWO) was in 55 hedge funds’ portfolios at the end of December. The all time high for this statistic is 66. Our calculations also showed that TTWO isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). With all of this in mind we’re going to take a glance at the fresh hedge fund action surrounding Take-Two Interactive Software, Inc. (NASDAQ:TTWO).

Do Hedge Funds Think TTWO Is A Good Stock To Buy Now?

At the end of December, a total of 55 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. On the other hand, there were a total of 59 hedge funds with a bullish position in TTWO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the biggest position in Take-Two Interactive Software, Inc. (NASDAQ:TTWO), worth close to $273.3 million, corresponding to 0.3% of its total 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $142.1 million position; 0.2% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions comprise Brandon Haley’s Holocene Advisors, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Christopher R. Hansen’s Valiant Capital. In terms of the portfolio weights assigned to each position Tensile Capital allocated the biggest weight to Take-Two Interactive Software, Inc. (NASDAQ:TTWO), around 8.25% of its 13F portfolio. Marlowe Partners is also relatively very bullish on the stock, designating 7.37 percent of its 13F equity portfolio to TTWO.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the biggest position in Take-Two Interactive Software, Inc. (NASDAQ:TTWO). Balyasny Asset Management had $46.1 million invested in the company at the end of the quarter. Tim David’s Guardian Point Capital also made a $10.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Nicholas Bagnall’s Te Ahumairangi Investment Management, Benjamin A. Smith’s Laurion Capital Management, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s go over hedge fund activity in other stocks similar to Take-Two Interactive Software, Inc. (NASDAQ:TTWO). We will take a look at Franco-Nevada Corporation (NYSE:FNV), Carnival Corporation & plc (NYSE:CCL), Fortive Corporation (NYSE:FTV), Arthur J. Gallagher & Co. (NYSE:AJG), Edison International (NYSE:EIX), Maxim Integrated Products Inc. (NASDAQ:MXIM), and Rogers Communications Inc. (NYSE:RCI). This group of stocks’ market caps are similar to TTWO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNV | 27 | 1224140 | -4 |

| CCL | 47 | 1196934 | 10 |

| FTV | 33 | 1116808 | -1 |

| AJG | 24 | 142669 | -11 |

| EIX | 30 | 1441563 | 2 |

| MXIM | 54 | 2844204 | 2 |

| RCI | 15 | 279915 | 0 |

| Average | 32.9 | 1178033 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.9 hedge funds with bullish positions and the average amount invested in these stocks was $1178 million. That figure was $1513 million in TTWO’s case. Maxim Integrated Products Inc. (NASDAQ:MXIM) is the most popular stock in this table. On the other hand Rogers Communications Inc. (NYSE:RCI) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is more popular among hedge funds. Our overall hedge fund sentiment score for TTWO is 83. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Unfortunately TTWO wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on TTWO were disappointed as the stock returned -18.3% since the end of the fourth quarter (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.