Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

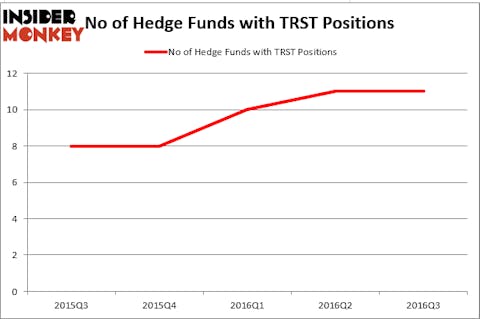

TrustCo Bank Corp NY (NASDAQ:TRST) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of September, same as at the end of June. At the end of this article we will also compare TRST to other stocks including Flushing Financial Corporation (NASDAQ:FFIC), Civitas Solutions Inc (NYSE:CIVI), and MGP Ingredients Inc (NASDAQ:MGPI) to get a better sense of its popularity.

Follow Trustco Bank Corp N Y (NASDAQ:TRST)

Follow Trustco Bank Corp N Y (NASDAQ:TRST)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alix Kreil/Shutterstock.com

How are hedge funds trading TrustCo Bank Corp NY (NASDAQ:TRST)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TRST over the last 5 quarters, which is holding steady at its peak for the year. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, led by Chuck Royce, holds the most valuable position in TrustCo Bank Corp NY (NASDAQ:TRST). Royce & Associates has a $58 million position in the stock. On Royce & Associates’ heels is Renaissance Technologies, one of the largest hedge funds in the world, holding an $8.4 million position. Other members of the smart money that are bullish include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Israel Englander’s Millennium Management, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

We view hedge fund activity in the stock as unfavorable, but in this case there was only a single hedge fund selling its entire position: Balyasny Asset Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Highbridge Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to TrustCo Bank Corp NY (NASDAQ:TRST). We will take a look at Flushing Financial Corporation (NASDAQ:FFIC), Civitas Solutions Inc (NYSE:CIVI), MGP Ingredients Inc (NASDAQ:MGPI), and Echo Global Logistics, Inc. (NASDAQ:ECHO). This group of stocks’ market caps resemble TRST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FFIC | 10 | 42509 | 3 |

| CIVI | 8 | 9503 | 1 |

| MGPI | 8 | 53307 | 1 |

| ECHO | 9 | 38125 | -1 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $75 million in TRST’s case. Flushing Financial Corporation (NASDAQ:FFIC) is the most popular stock in this table. On the other hand Civitas Solutions Inc (NYSE:CIVI) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks TrustCo Bank Corp NY (NASDAQ:TRST) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None