Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of TripAdvisor, Inc. (NASDAQ:TRIP) based on that data.

Hedge fund interest in TripAdvisor, Inc. (NASDAQ:TRIP) shares was flat at the end of last quarter with 26 smart money investors long the stock. This is usually a negative indicator. Further more, the company hasn’t attracted many of the wealthiest hedge fund managers out there (and if you won’t to know which stocks did, take a look at the list of 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index). Still, this is not enough information for us to determine whether TripAdvisor, Inc. is a good stock to buy, hence at the end of this article we will also compare TRIP to other stocks including VEREIT, Inc. (NYSE:VER), AMERCO (NASDAQ:UHAL), and Flex Ltd. (NASDAQ:FLEX) to get a better sense of its popularity.

According to most investors, hedge funds are assumed to be unimportant, old financial tools of yesteryear. While there are over 8000 funds with their doors open at present, Our researchers choose to focus on the top tier of this club, approximately 700 funds. These investment experts orchestrate the majority of all hedge funds’ total asset base, and by observing their best investments, Insider Monkey has come up with many investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

While examining the stock further, we found an interesting opinion on it, coming from Greenhaven Road Capital’s investor letter. Greenhaven Road Capital has been long the stock for a while and still has enthusiasm about it, as you can read below:

“TripAdvisor remains the dominant travel research company and maintains the largest installed base for travel apps. The company continues to make progress on their in-destination business for local tours and activities, and has been optimizing ad spending on the hotel business to improve profitability. We continue to hold the shares as it is entirely plausible that TripAdvisor can improve their monetization rates on the $1.3+ trillion in travel spend it influences. The company has announced but not rolled out a new version of the site, which features a personal travel feed that makes it easier to plan and book travel while putting an emphasis on friend and influencer recommendations when available. Like any major overhaul, it has the possibility of improving the experience and economics… or not. Time will tell.”

Even Greenhaven Road Capital’s bright perspective on the future operations of the company is not enough for us to conclude if TRIP is worth purchasing, which is why we’ll continue with our analysis, and take a look at the recent key hedge fund action regarding the stock.

Hedge fund activity in TripAdvisor, Inc. (NASDAQ:TRIP)

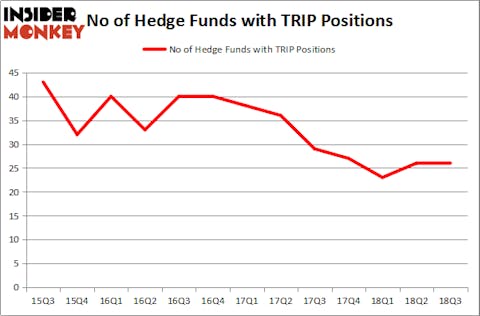

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, same as in the previous quarter. Below, you can check out the change in hedge fund sentiment towards TRIP over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Eagle Capital Management was the largest shareholder of TripAdvisor, Inc. (NASDAQ:TRIP), with a stake worth $522.4 million reported as of the end of September. Trailing Eagle Capital Management was Bares Capital Management, which amassed a stake valued at $260.3 million. SRS Investment Management, D E Shaw, and PAR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since TripAdvisor, Inc. (NASDAQ:TRIP) has faced a decline in interest from the entirety of the hedge funds we track, logic holds that there is a sect of fund managers that slashed their positions entirely heading into Q3. Intriguingly, Lei Zhang’s Hillhouse Capital Management sold off the largest stake of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $75.8 million in stock, and Robert Joseph Caruso’s Select Equity Group was right behind this move, as the fund dropped about $55.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to TripAdvisor, Inc. (NASDAQ:TRIP). These stocks are VEREIT, Inc. (NYSE:VER), AMERCO (NASDAQ:UHAL), Flex Ltd. (NASDAQ:FLEX), and The Chemours Company (NYSE:CC). All of these stocks’ market caps match TRIP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VER | 22 | 491655 | -3 |

| UHAL | 8 | 409239 | 0 |

| FLEX | 26 | 935426 | -4 |

| CC | 31 | 791928 | 0 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $657 million. That figure was $1.45 billion in TRIP’s case. The Chemours Company (NYSE:CC) is the most popular stock in this table. On the other hand AMERCO (NASDAQ:UHAL) is the least popular one with only 8 bullish hedge fund positions. TripAdvisor, Inc. (NASDAQ:TRIP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.