Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Is Travelport Worldwide Ltd (NYSE:TVPT) the right pick for your portfolio? Hedge funds are selling. The number of long hedge fund positions decreased by 2 recently. TVPT was in 26 hedge funds’ portfolios at the end of the third quarter of 2016. There were 28 hedge funds in our database with TVPT holdings at the end of the previous quarter. At the end of this article we will also compare TVPT to other stocks including CBL & Associates Properties, Inc. (NYSE:CBL), Aaron’s, Inc. (NYSE:AAN), and Agios Pharmaceuticals Inc (NASDAQ:AGIO) to get a better sense of its popularity.

Follow Travelport Worldwide Ltd (NYSE:TVPT)

Follow Travelport Worldwide Ltd (NYSE:TVPT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

With all of this in mind, let’s check out the fresh action encompassing Travelport Worldwide Ltd (NYSE:TVPT).

How are hedge funds trading Travelport Worldwide Ltd (NYSE:TVPT)?

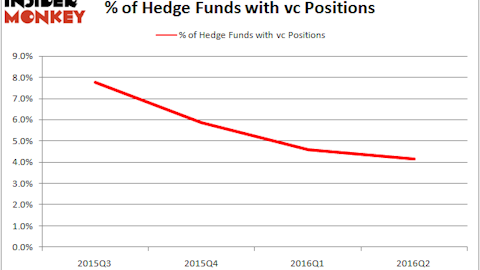

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 7% from the previous quarter. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Solus Alternative Asset Management, run by Christopher Pucillo, holds the number one position in Travelport Worldwide Ltd (NYSE:TVPT). According to regulatory filings, the fund has an $89.6 million position in the stock, comprising 24.9% of its 13F portfolio. On Solus Alternative Asset Management’s heels is Parag Vora of HG Vora Capital Management, with a $45.1 million position; the fund has 5.8% of its 13F portfolio invested in the stock. Some other peers with similar optimism comprise Amit Nitin Doshi’s Harbor Spring Capital, George Soros’s Soros Fund Management and Will Cook’s Sunriver Management.