There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Townsquare Media Inc (NYSE:TSQ).

Hedge fund interest towards Townsquare Media Inc (NYSE:TSQ) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Global Medical REIT Inc (NYSE:GMRE), TriplePoint Venture Growth BDC Corp (NYSE:TPVG), and Consolidated Water Co. Ltd. (NASDAQ:CWCO) to gather more data points.

Follow Townsquare Media Inc. (NYSE:TSQ)

Follow Townsquare Media Inc. (NYSE:TSQ)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Keeping this in mind, let’s take a peek at the key action regarding Townsquare Media Inc (NYSE:TSQ).

How are hedge funds trading Townsquare Media Inc (NYSE:TSQ)?

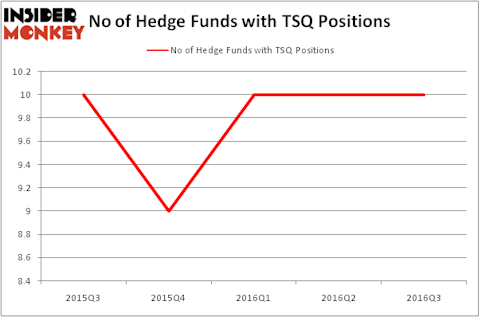

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the previous quarter. By comparison, nine hedge funds held shares or bullish call options in TSQ heading into this year. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Glenn Fuhrman and John Phelan’s MSD Capital has the largest position in Townsquare Media Inc (NYSE:TSQ), worth close to $15.3 million, amounting to 3.8% of its total 13F portfolio. The second most bullish fund manager is Oaktree Capital Management, led by Howard Marks, holding a $14.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish consist of Michael Barnes and Arif Inayatullah’s Tricadia Capital Management, Charles Paquelet’s Skylands Capital, and Spencer M. Waxman’s Shannon River Fund Management. We should note that Shannon River Fund Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.