Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Is QUALCOMM, Inc. (NASDAQ:QCOM) the right pick for your portfolio? Even though the stock has gone nowhere in the last 5 years, hedge fund managers are betting on the stock. The number of long hedge fund positions went up by 7 lately, though QCOM is still not among the 30 most popular stocks among hedge funds. Nevertheless, Coatue Management’s Philippe Laffont praised the stock in his 2018 Q3 investor letter (email us if you want a copy of this investor letter):

“Qualcomm is the global leader in wireless technology and is best positioned to benefit from the transition from LTE to the next-generation wireless network, 5G, enabling a “smart” world – smart cars, smart cities, smart buildings and shopping centers over the coming years. With almost three years of M&A uncertainty behind them, management is focused on costcutting, shareholder returns and positioning itself to capitalize on the 5G transition. We think the company is attractively priced at 10x earnings, based on company guidance, with significant runway for growth over the next several years.”

At the moment there are a large number of tools market participants put to use to value stocks. A duo of the best tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top money managers can outperform their index-focused peers by a solid amount (see the details here).

Let’s review the new hedge fund action regarding QUALCOMM, Inc. (NASDAQ:QCOM).

How are hedge funds trading QUALCOMM, Inc. (NASDAQ:QCOM)?

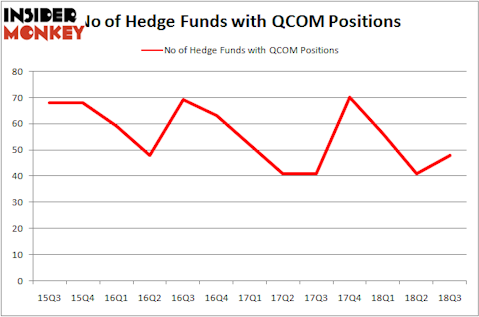

At the end of the third quarter, a total of 48 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in QCOM over the last 13 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, D E Shaw held the most valuable stake in QUALCOMM, Inc. (NASDAQ:QCOM), which was worth $716.8 million at the end of the third quarter. On the second spot was Coatue Management which amassed $579.7 million worth of shares. Moreover, Point72 Asset Management, Millennium Management, and Citadel Investment Group were also bullish on QUALCOMM, Inc. (NASDAQ:QCOM), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, some big names were leading the bulls’ herd. Coatue Management, managed by Philippe Laffont, created the most outsized position in QUALCOMM, Inc. (NASDAQ:QCOM). Coatue Management had $579.7 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $357.9 million position during the quarter. The other funds with new positions in the stock are Robert Boucai’s Newbrook Capital Advisors, Stanley Druckenmiller’s Duquesne Capital, and Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks similar to QUALCOMM, Inc. (NASDAQ:QCOM). These stocks are Texas Instruments Incorporated (NASDAQ:TXN), Paypal Holdings Inc (NASDAQ:PYPL), Costco Wholesale Corporation (NASDAQ:COST), and Broadcom Inc (NASDAQ:AVGO). This group of stocks’ market caps resemble QCOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TXN | 48 | 2380065 | 10 |

| PYPL | 97 | 4842898 | 11 |

| COST | 39 | 2833722 | -1 |

| AVGO | 49 | 4093454 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 58.25 hedge funds with bullish positions and the average amount invested in these stocks was $3538 million. That figure was $3172 million in QCOM’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand Costco Wholesale Corporation (NASDAQ:COST) is the least popular one with only 39 bullish hedge fund positions. QUALCOMM, Inc. (NASDAQ:QCOM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PYPL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.