The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Theravance Biopharma Inc (NASDAQ:TBPH).

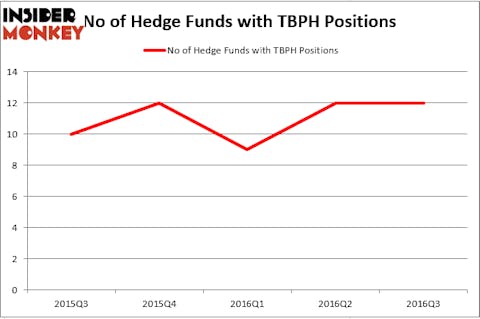

Theravance Biopharma Inc (NASDAQ:TBPH) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of September, same as at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RingCentral Inc (NYSE:RNG), Plantronics, Inc. (NYSE:PLT), and DigitalGlobe Inc (NYSE:DGI) to gather more data points.

Follow Theravance Biopharma Inc. (NASDAQ:TBPH)

Follow Theravance Biopharma Inc. (NASDAQ:TBPH)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

How are hedge funds trading Theravance Biopharma Inc (NASDAQ:TBPH)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards TBPH over the last 5 quarters, including a Q1 dip and Q2 rebound. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Neil Woodford’s Woodford Investment Management has the most valuable position in Theravance Biopharma Inc (NASDAQ:TBPH), worth close to $340.9 million, corresponding to 13.8% of its total 13F portfolio. On Woodford Investment Management’s heels is Baupost Group, led by Seth Klarman, which holds a $266.4 million position; the fund has 3.8% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism consist of Bihua Chen’s Cormorant Asset Management, Kris Jenner, Gordon Bussard, and Graham McPhail’s Rock Springs Capital Management, and David Charney and Sky Wilber’s Foundation Asset Management. We should note that Foundation Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.