The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider The Liberty Braves Group (NASDAQ:BATRA) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

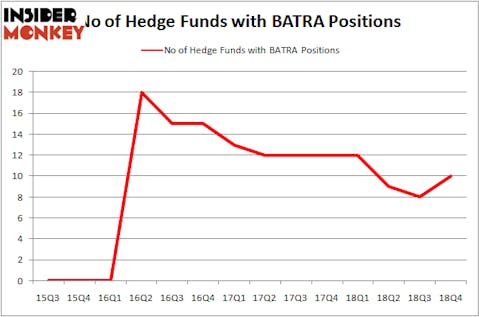

Is The Liberty Braves Group (NASDAQ:BATRA) a buy right now? The best stock pickers are becoming hopeful. The number of long hedge fund bets moved up by 2 lately. Our calculations also showed that BATRA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the new hedge fund action regarding The Liberty Braves Group (NASDAQ:BATRA).

Hedge fund activity in The Liberty Braves Group (NASDAQ:BATRA)

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BATRA over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, GAMCO Investors, managed by Mario Gabelli, holds the largest position in The Liberty Braves Group (NASDAQ:BATRA). GAMCO Investors has a $34.4 million position in the stock, comprising 0.3% of its 13F portfolio. The second most bullish fund manager is Peter S. Park of Park West Asset Management, with a $21.5 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Other peers that hold long positions contain Jim Simons’s Renaissance Technologies, Murray Stahl’s Horizon Asset Management and Jordan Moelis and Jeff Farroni’s Deep Field Asset Management.

Now, key money managers have jumped into The Liberty Braves Group (NASDAQ:BATRA) headfirst. Deep Field Asset Management, managed by Jordan Moelis and Jeff Farroni, initiated the most valuable position in The Liberty Braves Group (NASDAQ:BATRA). Deep Field Asset Management had $0.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.2 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Liberty Braves Group (NASDAQ:BATRA) but similarly valued. We will take a look at Tri Continental Corporation (NYSE:TY), Hub Group Inc (NASDAQ:HUBG), AMC Entertainment Holdings Inc (NYSE:AMC), and OneSmart International Education Group Limited (NYSE:ONE). This group of stocks’ market caps resemble BATRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TY | 4 | 5516 | 2 |

| HUBG | 21 | 241245 | 0 |

| AMC | 21 | 89015 | 0 |

| ONE | 7 | 39567 | 2 |

| Average | 13.25 | 93836 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $64 million in BATRA’s case. Hub Group Inc (NASDAQ:HUBG) is the most popular stock in this table. On the other hand Tri Continental Corporation (NYSE:TY) is the least popular one with only 4 bullish hedge fund positions. The Liberty Braves Group (NASDAQ:BATRA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BATRA wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); BATRA investors were disappointed as the stock returned 13.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.