After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards The Hackett Group, Inc. (NASDAQ:HCKT).

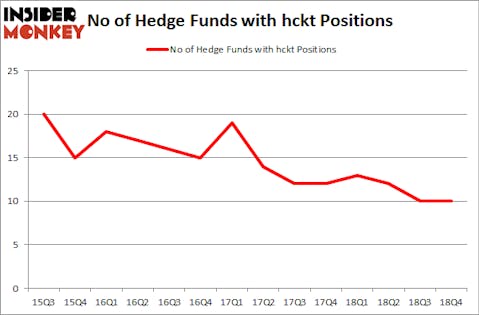

The Hackett Group, Inc. (NASDAQ:HCKT) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Dorchester Minerals LP (NASDAQ:DMLP), Control4 Corp (NASDAQ:CTRL), and One Liberty Properties, Inc. (NYSE:OLP) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

We’re going to take a glance at the fresh hedge fund action regarding The Hackett Group, Inc. (NASDAQ:HCKT).

What have hedge funds been doing with The Hackett Group, Inc. (NASDAQ:HCKT)?

Heading into the first quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in HCKT a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Douglas T. Granat’s Trigran Investments has the biggest position in The Hackett Group, Inc. (NASDAQ:HCKT), worth close to $25.7 million, amounting to 4.8% of its total 13F portfolio. Coming in second is Renaissance Technologies, managed by Jim Simons, which holds a $17.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism consist of Chuck Royce’s Royce & Associates, Cliff Asness’s AQR Capital Management and Noam Gottesman’s GLG Partners.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Hackett Group, Inc. (NASDAQ:HCKT) but similarly valued. We will take a look at Dorchester Minerals LP (NASDAQ:DMLP), Control4 Corp (NASDAQ:CTRL), One Liberty Properties, Inc. (NYSE:OLP), and Zymeworks Inc. (NYSE:ZYME). All of these stocks’ market caps are similar to HCKT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DMLP | 6 | 28582 | 0 |

| CTRL | 12 | 34532 | 0 |

| OLP | 5 | 22345 | -1 |

| ZYME | 11 | 103481 | -2 |

| Average | 8.5 | 47235 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $63 million in HCKT’s case. Control4 Corp (NASDAQ:CTRL) is the most popular stock in this table. On the other hand One Liberty Properties, Inc. (NYSE:OLP) is the least popular one with only 5 bullish hedge fund positions. The Hackett Group, Inc. (NASDAQ:HCKT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HCKT wasn’t nearly as popular as these 15 stock and hedge funds that were betting on HCKT were disappointed as the stock returned -4.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.