Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does The Boeing Company (NYSE:BA) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

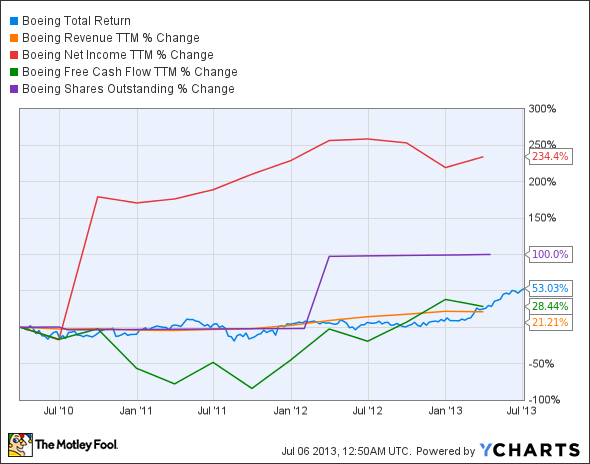

The graphs you’re about to see tell The Boeing Company (NYSE:BA)’s story, and we’ll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at The Boeing Company (NYSE:BA)’s key statistics:

BA Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 21.2% | Fail |

| Improving profit margin | 175.9% | Pass |

| Free cash flow growth > Net income growth | 28.4% vs. 234.4% | Fail |

| Improving EPS | 222.2% | Pass |

| Stock growth (+ 15%) < EPS growth | 53% vs 222.2% | Pass |

Source: YCharts.

*Period begins at end of Q1 2010.

BA Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (62.5%) | Fail |

| Declining debt to equity | (72.1%) | Pass |

| Dividend growth > 25% | 15.5% | Fail |

| Free cash flow payout ratio < 50% | 25.3% | Pass |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we’re going

The Boeing Company (NYSE:BA), one of the largest aircraft manufacturers in the world, doesn’t quite come through with flying colors, as it’s mustered only five out of nine possible passing grades. It’s worth pointing out that despite Boeing’s net income growth far outpacing free cash flow during our tracking period, the raw numbers show that Boeing’s most recent trailing 12-month free cash flow is actually higher than its net income. Despite its weaknesses, The Boeing Company (NYSE:BA)’s shares have enjoyed significant growth over the past two years, and it has a very good chance to improve on its score next time around once the big jump seen in 2010 ages out of our tracking period. But does that mean Boeing will keep outperforming in the future? Let’s dig a little deeper.

Boeing has been working hard to increase production of its fast-selling commercial jets, and the company is beginning to see its efforts rewarded. Boeing has delivered 169 planes in the second quarter, making 306 complete deliveries for the year. About 70% of these were Boeing’s 737 Next Generation, a narrow-body jet due to completely replace the 737 in 2017. The 737 is Boeing’s most popular jet, and the company is in the process of boosting production from 35 to 48 jets per month.

The second quarter also saw The Boeing Company (NYSE:BA) resume delivery of its flagship 787 Dreamliner after working through some scary technical issues. Boeing delivered 16 more Dreamliners in the second quarter. At a list price of over $200 million, the Dreamliner is big business for Boeing. The company is aggressively trying to raise production rates on the Dreamliner to 10 planes per month. Boeing has beaten its chief competitor Airbus on total commercial deliveries for the year to date, which is a good sign that its Dreamliner problems have not caused a production bottleneck.

Boeing also announced a new, larger version of the Dreamliner at the Paris Air Show last month. Initial orders have already rolled in from several airlines — United Continental Holdings Inc (NYSE:UAL) signed up to buy 20 of the new birds, and Air Lease Corp (NYSE:AL) and Singapore Airlines both plunked down a big order for 30 of the larger Dreamliners apiece. The updated 787-10 Dreamliner attacks the Airbus A350’s target market, and is expected to offer better fuel efficiency than the comparable Airbus jet. However, EasyJet decided to go with Boeing’s rival, placing a massive order for 135 planes from Airbus, 100 of which will be A320neos.

Boeing is also continuing to scoop up defense contracts left and right. The Bell-Boeing Joint Project Office, a joint venture between Boeing and the Textron Inc. (NYSE:TXT) subsidiary, was awarded a $100 million contract from the Department of Defense to produce 17 to 21 V-22 Ospreys for the U.S. Navy, and one MV-22 for the U.S. Marine Corps by November 2016. Last month, the company also bagged two multi-billion dollar orders of $4.8 billion and $3.4 billion to build a total of 177 CH-47F Chinook heavy lift helicopters for the Army. Boeing’s dominant position seems assured for the time being, giving investors good reason to ponder adding its shares to their portfolio in spite of a less-than-perfect performance on our analysis today.

Putting the pieces together

Today, The Boeing Company (NYSE:BA) has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is Boeing Destined for Greatness? originally appeared on Fool.com and is written by Alex Planes.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool owns shares of Textron.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.