A 276.5% annual return isn’t something you see everyday, especially in the automobile industry. That’s what Tesla Motors Inc (NASDAQ:TSLA) is all about: growth. Such a return dwarfs even the 85% seen by Ford Motor Company (NYSE:F) or the 70% of Toyota Motor Corporation (ADR) (NYSE:TM), which has recently benefited from a weaker yen. Yet, Tesla Motors Inc (NASDAQ:TSLA) not only has managed to almost triple its market capitalization in one year (currently $13.83B), but some of its most optimistic supporters consider this just the beginning, as they see Tesla as the future of transportation. But, objectively speaking, does Tesla really represent the future of transportation, or is it yet another story of market insanity?

Understanding Tesla

We have to start by admitting that Tesla Motors Inc (NASDAQ:TSLA) isn’t a normal auto stock. Unlike Ford, it does not have to deal with strong unions, due to the small size of the company. It enjoys tax credits for the time being, at least until the company manages to sell 200,000 electric cars (after that, the tax credits are expected to decrease). Unlike Toyota, it is not heavily exposed to currency fluctuations yet. And unlike both Ford and Toyota, it actually benefits a lot from stricter environmental laws, which make normal cars more expensive to produce.

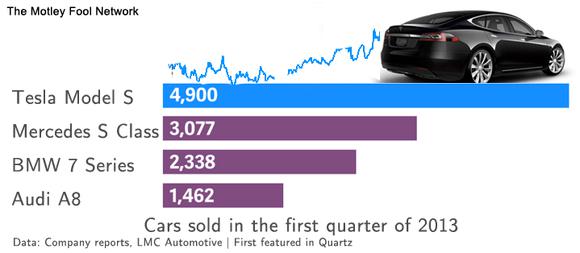

Finally, because its product is quite attractive and new to most consumers, it doesn’t need to invest heavily on advertising for the time being. Notice, however, that all these apparently strong competitive advantages are not scalable. As Tesla Motors Inc (NASDAQ:TSLA) continues increasing production, it will lose most of the advantages mentioned earlier, from enjoying tax credits to having a low marketing budget. Well, Tesla is increasing production steadily. In the first quarter of 2013, the Model S electric sports sedan outsold by wide margins the Mercedes S Class, the BMW 7 Series and the Audi A8. At first glance, this looks great. But considering Tesla’s main advantages are not scalable, it also brings worries.

Profitability

Even if Tesla Motors Inc (NASDAQ:TSLA) is about to lose some significant benefits, in theory everything should be all right if the car manufacturer enjoys economies of scale. As production increases and fixed costs get more diluted, Tesla could use its higher margins to offset the negative effect of having no more tax credits. But will Tesla be able to increase its margins? So far, the current gross margin without credits is a mere 2.3%, although Tesla CEO Elon Musk has stated that his goal is to achieve a 25% gross margin for Tesla’s high-end cars without the inclusion of regular credits. This is higher than BMW’s 19% overall gross margins, and I personally have no idea how Tesla will be able to achieve this in the coming years, as the guidance looks pretty high.

The bear case

The bear case, presented by Mark B. Spiegel, generously assumes that Tesla will indeed achieve a 25% gross margin for its high-end cars. If by 2018 Tesla sells 80,000 high-end vehicles at an average price of $85,000 per unit and 200,000 Gen 3 cars (with a 15% profit margin) at an average price of $45,000 per unit, the company would be worth $15.8 billion (revenue). At a 1.3x BMW-like valuation multiple, that is $18.6 billion. Notice that this is a very optimistic scenario.

Now, you have a $18.6 billion enterprise value for 2018, so discount it back by 15% a year and you get a present value of roughly $9.2 billion, which divided by the total number of outstanding shares, gives a $73 per-share estimate, well below the current $125 share price. Therefore, even under a very optimistic scenario, I find that Tesla is grossly overvalued. As a matter of fact, it is so overvalued, that as Jae Jung from Old School Value wisely puts it, it makes no sense to check the fundamentals of the stock or to even try to value it. Tesla is purely a story stock at the moment.

Recall also that Tesla’s P/E ratio is negative simply because the company is not yet in the profit zone. On the other hand, Toyota’s 21.04 and Ford’s 11.49 are both low and positive. According to Nasdaq and Zacks Investment Research, the forecasted P/E ratio for Tesla next year is 243!

The bull case

The bull case is quite emotional. First of all, nobody knows the potential market size. Some estimates suggest that the sales of all types of electric vehicles could be as high as 20% of the total U.S. auto market by 2020, but there are more optimistic ones. Considering that Tesla is probably the only electric-auto maker that is prepared for such a massive increase in demand, it makes sense to be long now. After all, Tesla is the only well-established electric car maker so far.

The other reason for being long Tesla is because both the increasing media coverage and the fact that it will join the NASDAQ-100 Equal Weighted Index will cause a further increase in demand for shares. So, even if the current stock price is way above the value that fundamentals dictate, an almost guaranteed further increase in demand for the coming months makes this a buy.

The bottom line

Personally, I think that we should not be overoptimistic with Tesla. Those who say that Tesla cars will replace traditional cars by 2020 may be too emotional, because that means an exploding growth rate in electric car sales has to take place in the coming quarters, which is not going to happen unless there is an external catalyst. However, Tesla does offer something new, artistic, clean, and luxurious – qualities appreciated by the higher-end segment of the market. In a nutshell, I believe Tesla will play a leading position in the future of transportation, but will not become the future of transportation.

In terms of value and fundamentals, Tesla is clearly an emotional stock. But the fact that it is highly overvalued does not mean it can’t be a great short-term investment. In other words, I see Tesla as a trading vehicle, rather than a long-term investment. It could be, in the future, a long-term investment, but the market will need to learn how to value an electric-car maker first. Tesla is not a value stock. Ford Motor Company (NYSE:F), on the other hand, may not be as artistic, revolutionary, and inspiring as Tesla, yet it has a lot of value to offer. Its past growth trajectory, recent dividend, and strategic partnerships with competitors suggest a higher P/E ratio than 11.5. Furthermore, the company surpassed its cash total for all of 2012 in only seven months. Unlike Tesla, Ford is showing solid signals that it is improving its free cash flow, but it does not have the same media coverage Tesla does. After posting amazing results in the latest earnings call, stock increased just 2.5%.

Finally, although I said that Tesla is probably the only well-established electric-car marker at the moment, this could change any moment. I doubt a new player will appear all of a sudden, because barriers to entry are not that low. However, a giant like Toyota Motor Corporation (ADR) (NYSE:TM) has both the resources and technology to become a formidable competitor. Toyota, after all, provides the only other car available for this year that has an electric-only range of over 100 miles: the Toyota RAV4 EV. Ironically (but not surprisingly), the powertrain and battery of this car has been engineered by Tesla Motors.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Ford and Tesla Motors . The Motley Fool owns shares of Ford and Tesla Motors.

The article Is Tesla the Future of Transportation, or Is the Market Insane? originally appeared on Fool.com and is written by Adrian Campos.

Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.