While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Tesla Inc. (NASDAQ:TSLA).

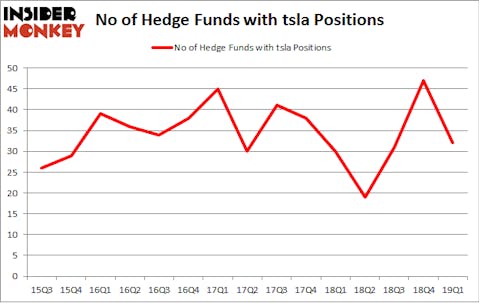

Is Tesla Inc. (NASDAQ:TSLA) a worthy investment today? The best stock pickers are getting less optimistic. The number of bullish hedge fund bets dropped by 15 in recent months. Our calculations also showed that tsla isn’t among the 30 most popular stocks among hedge funds. TSLA was in 32 hedge funds’ portfolios at the end of March. There were 47 hedge funds in our database with TSLA positions at the end of the previous quarter.

If you’d ask most market participants, hedge funds are assumed to be worthless, old investment tools of yesteryear. While there are more than 8000 funds in operation at present, Our researchers hone in on the elite of this club, approximately 750 funds. It is estimated that this group of investors control most of the hedge fund industry’s total capital, and by following their top picks, Insider Monkey has brought to light a few investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Matthew Hulsizer of PEAK6 Capital

We’re going to go over the recent hedge fund action surrounding Tesla Inc. (NASDAQ:TSLA).

Hedge fund activity in Tesla Inc. (NASDAQ:TSLA)

Heading into the second quarter of 2019, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -32% from the fourth quarter of 2018. On the other hand, there were a total of 30 hedge funds with a bullish position in TSLA a year ago. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the number one call position in Tesla Inc. (NASDAQ:TSLA), worth close to $781.5 million, corresponding to 0.4% of its total 13F portfolio. On Citadel Investment Group’s heels is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $320.3 million position; 0.8% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions include Ken Griffin’s Citadel Investment Group, and Jim Simons’s Renaissance Technologies.

Because Tesla Inc. (NASDAQ:TSLA) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of money managers that elected to cut their full holdings last quarter. Interestingly, Nick Niell’s Arrowgrass Capital Partners said goodbye to the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $157 million in stock, and Gilchrist Berg’s Water Street Capital was right behind this move, as the fund dropped about $117.1 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 15 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tesla Inc. (NASDAQ:TSLA) but similarly valued. These stocks are Zoetis Inc (NYSE:ZTS), The Bank of New York Mellon Corporation (NYSE:BK), Honda Motor Co Ltd (NYSE:HMC), and Bank of Montreal (NYSE:BMO). All of these stocks’ market caps are similar to TSLA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZTS | 37 | 2348595 | -8 |

| BK | 36 | 5272376 | 11 |

| HMC | 9 | 67519 | -4 |

| BMO | 15 | 333732 | 0 |

| Average | 24.25 | 2005556 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $2006 million. That figure was $1067 million in TSLA’s case. Zoetis Inc (NYSE:ZTS) is the most popular stock in this table. On the other hand Honda Motor Co Ltd (NYSE:HMC) is the least popular one with only 9 bullish hedge fund positions. Tesla Inc. (NASDAQ:TSLA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TSLA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TSLA were disappointed as the stock returned -32.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.