Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Teladoc Health, Inc. (NYSE:TDOC).

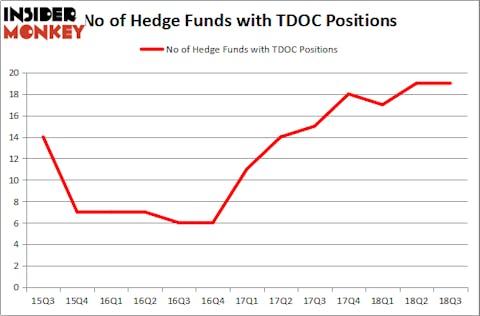

Hedge fund interest in Teladoc Health, Inc. (NYSE:TDOC) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare TDOC to other stocks including People’s United Financial, Inc. (NASDAQ:PBCT), Ternium S.A. (NYSE:TX), and Vectren Corporation (NYSE:VVC) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the recent hedge fund action surrounding Teladoc Health, Inc. (NYSE:TDOC).

What does the smart money think about Teladoc Health, Inc. (NYSE:TDOC)?

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, representing no change from the second quarter of 2018. On the other hand, there were a total of 18 hedge funds with a bullish position in TDOC at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Teladoc Health, Inc. (NYSE:TDOC) was held by Millennium Management, which reported holding $123.6 million worth of stock at the end of September. It was followed by Columbus Circle Investors with a $36.5 million position. Other investors bullish on the company included Driehaus Capital, Redmile Group, and Sectoral Asset Management.

Judging by the fact that Teladoc Health, Inc. (NYSE:TDOC) has witnessed declining sentiment from hedge fund managers, it’s safe to say that there lies a certain “tier” of funds who sold off their positions entirely in the third quarter. At the top of the heap, Joseph Edelman’s Perceptive Advisors said goodbye to the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling close to $11.3 million in stock, and Bruce Garelick’s Garelick Capital Partners was right behind this move, as the fund dropped about $10.9 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Teladoc Health, Inc. (NYSE:TDOC). We will take a look at People’s United Financial, Inc. (NASDAQ:PBCT), Ternium S.A. (NYSE:TX), Vectren Corporation (NYSE:VVC), and Haemonetics Corporation (NYSE:HAE). This group of stocks’ market valuations match TDOC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PBCT | 20 | 121306 | 7 |

| TX | 14 | 128533 | -1 |

| VVC | 19 | 553603 | 0 |

| HAE | 22 | 573018 | -2 |

| Average | 18.75 | 344115 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $344 million. That figure was $358 million in TDOC’s case. Haemonetics Corporation (NYSE:HAE) is the most popular stock in this table. On the other hand Ternium S.A. (NYSE:TX) is the least popular one with only 14 bullish hedge fund positions. Teladoc Health, Inc. (NYSE:TDOC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HAE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.