The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Taylor Morrison Home Corp (NYSE:TMHC).

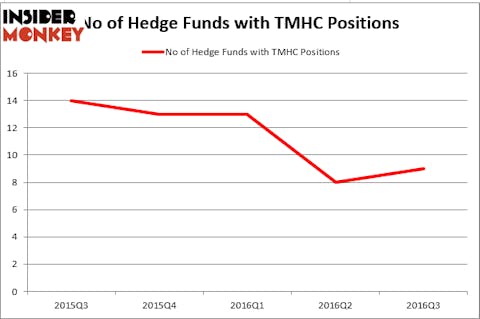

Is Taylor Morrison Home Corp (NYSE:TMHC) a bargain? Money managers are actually in a bullish mood. The number of bullish hedge fund bets improved by 1 lately. In this way, there were 9 hedge funds in our database with TMHC holdings at the end of the last quarter. At the end of this article we will also compare TMHC to other stocks including Neogen Corporation (NASDAQ:NEOG), Moog Inc (NYSE:MOG), and Criteo SA (ADR) (NASDAQ:CRTO) to get a better sense of its popularity.

Follow Taylor Morrison Home Corp (NYSE:TMHC)

Follow Taylor Morrison Home Corp (NYSE:TMHC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alexander Raths/Shutterstock.com

What does the smart money think about Taylor Morrison Home Corp (NYSE:TMHC)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 13% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in TMHC over the last 5 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Millennium Management, one of the 10 largest hedge funds in the world, holds the number one position in Taylor Morrison Home Corp (NYSE:TMHC). Millennium Management has a $6.8 million position in the stock. Sitting at the No. 2 spot is Ken Heebner of Capital Growth Management, with a $2.6 million position. Some other members of the smart money with similar optimism contain D. E. Shaw’s D E Shaw, and Emanuel J. Friedman’s EJF Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, specific money managers have jumped into Taylor Morrison Home Corp (NYSE:TMHC) headfirst. Balyasny Asset Management, led by Dmitry Balyasny, assembled the most outsized position in Taylor Morrison Home Corp (NYSE:TMHC). Balyasny Asset Management had $1.6 million invested in the company at the end of the quarter. Solomon Kumin’s Folger Hill Asset Management also initiated a $0.3 million position during the quarter. The following funds were also among the new TMHC investors: Mike Vranos’ Ellington and Neil Chriss’ Hutchin Hill Capital.

Let’s now review hedge fund activity in other stocks similar to Taylor Morrison Home Corp (NYSE:TMHC). These stocks are Neogen Corporation (NASDAQ:NEOG), Moog Inc (NYSE:MOG), Criteo SA (ADR) (NASDAQ:CRTO), and Sothebys (NYSE:BID). This group of stocks’ market caps are similar to TMHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEOG | 10 | 29219 | 0 |

| MOG | 17 | 91853 | 1 |

| CRTO | 13 | 132910 | 0 |

| BID | 20 | 559010 | 4 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $14 million in TMHC’s case. Sothebys (NYSE:BID) is the most popular stock in this table. On the other hand Neogen Corporation (NASDAQ:NEOG) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Taylor Morrison Home Corp (NYSE:TMHC) is even less popular than NEOG. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None