There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze SUPERVALU INC. (NYSE:SVU).

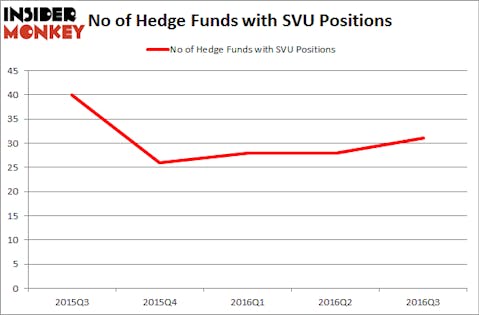

SUPERVALU INC. (NYSE:SVU) has seen an increase in enthusiasm from smart money of late. At the end of September, 31 funds tracked by Insider Monkey held shares of SVU, versus 28 funds at the end of June. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Neenah Paper, Inc. (NYSE:NP), Universal Corp (NYSE:UVV), and Exponent, Inc. (NASDAQ:EXPO) to gather more data points.

Follow Supervalu Inc (NYSE:SVU)

Follow Supervalu Inc (NYSE:SVU)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

LADO/Shutterstock.com

Keeping this in mind, we’re going to check out the recent action surrounding SUPERVALU INC. (NYSE:SVU).

How are hedge funds trading SUPERVALU INC. (NYSE:SVU)?

Heading into the fourth quarter of 2016, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on SUPERVALU INC. (NYSE:SVU), a change of 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SVU over the last five quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Conan Laughlin’s North Tide Capital has the largest position in SUPERVALU INC. (NYSE:SVU), worth close to $122.3 million, comprising 13.3% of its total 13F portfolio. On North Tide Capital’s heels is Glenhill Advisors, led by Glenn J. Krevlin, which holds a $83.8 million position; the fund has 5% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism encompass Cliff Asness’ AQR Capital Management, Marc Majzner’s Clearline Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, some big names have been driving this bullishness. Clearline Capital, led by Marc Majzner, established the most outsized position in SUPERVALU INC. (NYSE:SVU). Clearline Capital had $25.2 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $6.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Tom Sandell’s Sandell Asset Management, Don Morgan’s Brigade Capital, and William Charters and Mario Marcon’s Sabal Capital Management.

Let’s go over hedge fund activity in other stocks similar to SUPERVALU INC. (NYSE:SVU). These stocks are Neenah Paper, Inc. (NYSE:NP), Universal Corp (NYSE:UVV), Exponent, Inc. (NASDAQ:EXPO), and Wesco Aircraft Holdings Inc (NYSE:WAIR). All of these stocks’ market caps are similar to SVU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NP | 10 | 94224 | 3 |

| UVV | 14 | 67507 | 0 |

| EXPO | 8 | 60977 | -1 |

| WAIR | 12 | 277830 | -1 |

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $125 million, versus $324 million in SVU’s case. Universal Corp (NYSE:UVV) is the most popular stock in this table. On the other hand Exponent, Inc. (NASDAQ:EXPO) is the least popular one with only eight bullish hedge fund positions. Compared to these stocks SUPERVALU INC. (NYSE:SVU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none