The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Suncor Energy Inc. (NYSE:SU), and what that likely means for the prospects of the company and its stock.

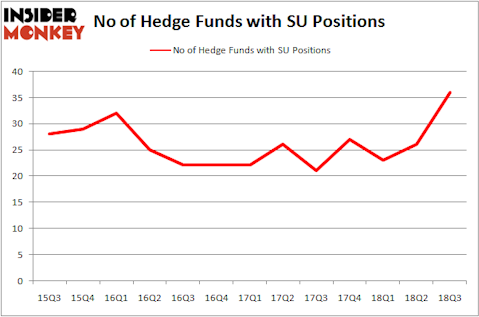

Is Suncor Energy Inc. (NYSE:SU) the right pick for your portfolio? Hedge funds are taking a bullish view. The number of bullish hedge fund positions advanced by 10 lately. Our calculations also showed that SU isn’t among the 30 most popular stocks among hedge funds. SU was in 36 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with SU positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to the beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

Let’s take a glance at the recent hedge fund action regarding Suncor Energy Inc. (NYSE:SU).

What have hedge funds been doing with Suncor Energy Inc. (NYSE:SU)?

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 38% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SU over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

The largest stake in Suncor Energy Inc. (NYSE:SU) was held by AQR Capital Management, which reported holding $185.9 million worth of stock at the end of September. It was followed by Point State Capital with a $130.9 million position. Other investors bullish on the company included Polar Capital, Citadel Investment Group, and Castle Hook Partners.

As one would reasonably expect, specific money managers have been driving this bullishness. Castle Hook Partners, managed by Josh Donfeld and David Rogers, initiated the largest position in Suncor Energy Inc. (NYSE:SU). Castle Hook Partners had $74.1 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $42.2 million investment in the stock during the quarter. The following funds were also among the new SU investors: Steve Cohen’s Point72 Asset Management, Jed Nussdorf’s Soapstone Capital, and Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors.

Let’s check out hedge fund activity in other stocks similar to Suncor Energy Inc. (NYSE:SU). We will take a look at Enterprise Products Partners L.P. (NYSE:EPD), Chubb Limited (NYSE:CB), Relx PLC (NYSE:RELX), and General Dynamics Corporation (NYSE:GD). This group of stocks’ market caps resemble SU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPD | 22 | 333199 | 0 |

| CB | 30 | 526955 | 7 |

| RELX | 5 | 114083 | -1 |

| GD | 35 | 8466691 | -6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $2.36 billion. That figure was $1.01 billion in SU’s case. General Dynamics Corporation (NYSE:GD) is the most popular stock in this table. On the other hand Relx PLC (NYSE:RELX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Suncor Energy Inc. (NYSE:SU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.