Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Stonegate Mortgage Corp (NYSE:SGM).

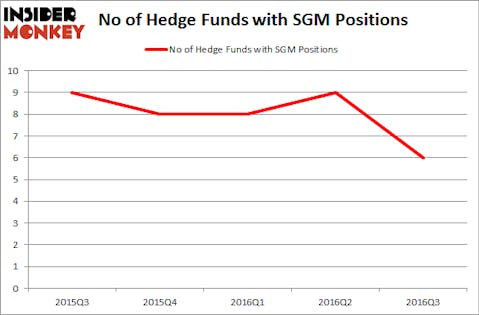

Stonegate Mortgage Corp (NYSE:SGM) shareholders have witnessed a decrease in hedge fund sentiment in recent months. SGM was in 6 hedge funds’ portfolios at the end of September. There were 9 hedge funds in our database with SGM holdings at the end of the previous quarter. At the end of this article we will also compare SGM to other stocks including Safe Bulkers, Inc. (NYSE:SB), Prudential Bancorp, Inc. of PA (NASDAQ:PBIP), and Ellington Residential Mortgage REIT (NYSE:EARN) to get a better sense of its popularity.

Follow Stonegate Mortgage Corp (CVE:SGM)

Follow Stonegate Mortgage Corp (CVE:SGM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alexandre Rotenberg / Shutterstock.com

Hedge fund activity in Stonegate Mortgage Corp (NYSE:SGM)

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 33% decline from the previous quarter. The graph below displays the number of hedge funds with bullish position in SGM over the last 5 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Long Pond Capital, led by John Khoury, holds the most valuable position in Stonegate Mortgage Corp (NYSE:SGM). Long Pond Capital has a $11.5 million position in the stock. On Long Pond Capital’s heels is Tom Brown of Second Curve Capital, with a $9.7 million position; the fund has 5.5% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism encompass Shawn Bergerson and Martin Kalish’s Waterstone Capital Management, Ari Zweiman’s 683 Capital Partners and D. E. Shaw’s D E Shaw, one of the largest hedge funds in the world. We should note that 683 Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Because Stonegate Mortgage Corp (NYSE:SGM) has gone through bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few hedgies that slashed their entire stakes heading into Q4. Intriguingly, Israel Englander’s Millennium Management cut the largest investment of the 700 funds studied by Insider Monkey, worth close to $0.2 million in stock, and Andy Redleaf’s Whitebox Advisors was right behind this move, as the fund dumped about $0.1 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Stonegate Mortgage Corp (NYSE:SGM). These stocks are Safe Bulkers, Inc. (NYSE:SB), Prudential Bancorp, Inc. of PA (NASDAQ:PBIP), Ellington Residential Mortgage REIT (NYSE:EARN), and Xenon Pharmaceuticals Inc (NASDAQ:XENE). This group of stocks’ market valuations are closest to SGM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SB | 5 | 6607 | -1 |

| PBIP | 4 | 23282 | 0 |

| EARN | 5 | 8311 | 5 |

| XENE | 10 | 58628 | 3 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $25 million in SGM’s case. Xenon Pharmaceuticals Inc (NASDAQ:XENE) is the most popular stock in this table. On the other hand Prudential Bancorp, Inc. of PA (NASDAQ:PBIP) is the least popular one with only 4 bullish hedge fund positions. Stonegate Mortgage Corp (NYSE:SGM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard XENE might be a better candidate to consider taking a long position in.

Disclosure: None