Several hedge fund billionaires took advantage of the sharp declines in broader market indices during the five hours following Donald Trump’s election victory. In this case markets wised up pretty quickly and the selloffs turned into rallies. Information disseminates very quickly in liquid markets, however, the rate of adjustment is usually slower when it comes to much smaller and less liquid markets. By tracking the hedge fund sentiment in publicly traded US stocks Insider Monkey aims to tap into hedge funds’ wisdom without paying them an arm and a leg. Historically their stock picks in small-cap stocks proved to be the most profitable. Let’s study the hedge fund sentiment to see how recent events affected their ownership of STMicroelectronics NV (ADR) (NYSE:STM) during the third quarter.

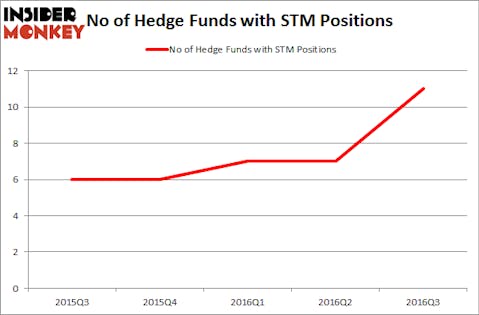

Is STMicroelectronics NV (ADR) (NYSE:STM) a sound investment today? It looks like money managers are betting on the stock as the number of bullish hedge fund positions went up by four during the third quarter. At the end of this article we will also compare STM to other stocks including Apollo Global Management LLC (NYSE:APO), Apartment Investment and Management Co. (NYSE:AIV), and Huntington Ingalls Industries Inc (NYSE:HII) to get a better sense of its popularity.

Follow Stmicroelectronics Nv (NYSE:STM)

Follow Stmicroelectronics Nv (NYSE:STM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Portogas D Ace/Shutterstock.com

Keeping this in mind, let’s review the key action regarding STMicroelectronics NV (ADR) (NYSE:STM).

What have hedge funds been doing with STMicroelectronics NV (ADR) (NYSE:STM)?

At the end of the third quarter, 11 funds tracked by Insider Monkey held long positions in this stock, up by 57% from the previous quarter. By comparison, only six hedge funds held shares or bullish call options in STM heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, one of the largest hedge funds in the world, has the biggest position in STMicroelectronics NV (ADR) (NYSE:STM), worth close to $40 million, amounting to 0.1% of its total 13F portfolio. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $33.1 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions comprise Ernest Chow and Jonathan Howe’s Sensato Capital Management, Israel Englander’s Millennium Management, and Warren Lammert’s Granite Point Capital. We should note that Sensato Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key money managers were breaking ground themselves. Millennium Management assembled the largest position in STMicroelectronics NV (ADR) (NYSE:STM). Millennium Management had $2.3 million invested in the company at the end of the quarter. Granite Point Capital also made a $2.2 million investment in the stock during the quarter. The other funds with brand new STM positions are Wojciech Uzdelewicz’s Espalier Global Management, Matthew Hulsizer’s PEAK6 Capital Management, and Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners.

Let’s now review hedge fund activity in other stocks similar to STMicroelectronics NV (ADR) (NYSE:STM). We will take a look at Apollo Global Management LLC (NYSE:APO), Apartment Investment and Management Co. (NYSE:AIV), Huntington Ingalls Industries Inc (NYSE:HII), and iShares Barclays 20+ Yr Treas.Bond (ETF)(NASDAQ:TLT). This group of stocks’ market caps resemble STM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APO | 21 | 272595 | 3 |

| AIV | 16 | 164712 | -4 |

| HII | 32 | 600672 | 1 |

| TLT | 20 | 652002 | 0 |

As you can see these stocks had an average of 22 funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $110 million in STM’s case. Huntington Ingalls Industries Inc (NYSE:HII) is the most popular stock in this table. On the other hand Apartment Investment and Management Co. (NYSE:AIV) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks STMicroelectronics NV (ADR) (NYSE:STM) is even less popular than AIV. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

European Countries With The Highest Military Strength

Super Easy Country Guitar Songs For Beginners

Biggest Ecommerce Websites In The World

Disclosure: None