Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: State Bank Financial Corp (NASDAQ:STBZ).

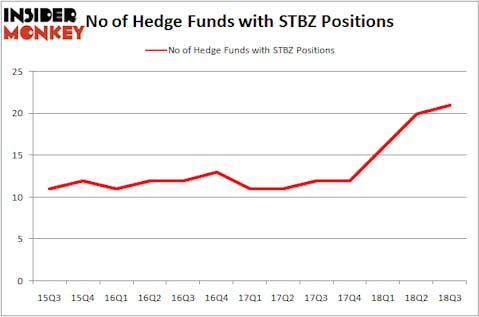

State Bank Financial Corp (NASDAQ:STBZ) has experienced an increase in hedge fund interest of late. Our calculations also showed that STBZ isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action regarding State Bank Financial Corp (NASDAQ:STBZ).

What does the smart money think about State Bank Financial Corp (NASDAQ:STBZ)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards STBZ over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Alpine Associates held the most valuable stake in State Bank Financial Corp (NASDAQ:STBZ), which was worth $19 million at the end of the third quarter. On the second spot was Water Island Capital which amassed $17.1 million worth of shares. Moreover, Private Capital Management, D E Shaw, and Diamond Hill Capital were also bullish on State Bank Financial Corp (NASDAQ:STBZ), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers have jumped into State Bank Financial Corp (NASDAQ:STBZ) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in State Bank Financial Corp (NASDAQ:STBZ). Arrowstreet Capital had $0.4 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.4 million investment in the stock during the quarter. The only other fund with a brand new STBZ position is Frederick DiSanto’s Ancora Advisors.

Let’s check out hedge fund activity in other stocks similar to State Bank Financial Corp (NASDAQ:STBZ). These stocks are Trupanion Inc (NYSE:TRUP), Apogee Enterprises, Inc. (NASDAQ:APOG), Apollo Investment Corp. (NASDAQ:AINV), and Despegar.com, Corp. (NYSE:DESP). This group of stocks’ market values resemble STBZ’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRUP | 9 | 128533 | 1 |

| APOG | 17 | 154251 | -3 |

| AINV | 8 | 27015 | -6 |

| DESP | 13 | 470216 | 2 |

| Average | 11.75 | 195004 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $195 million. That figure was $130 million in STBZ’s case. Apogee Enterprises, Inc. (NASDAQ:APOG) is the most popular stock in this table. On the other hand Apollo Investment Corp. (NASDAQ:AINV) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks State Bank Financial Corp (NASDAQ:STBZ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.