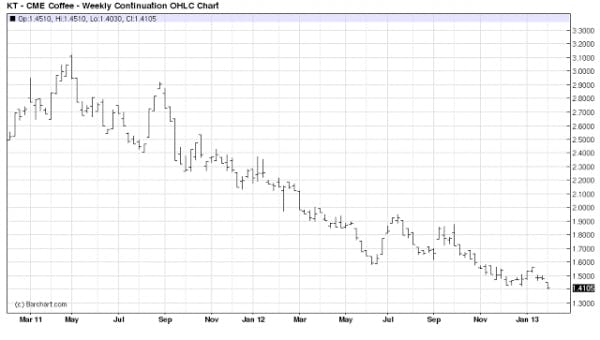

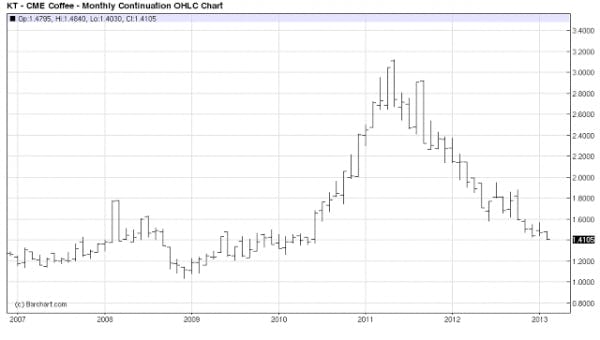

Over the past five years, Starbucks’ has seen a steady uptick in its profit margin despite the surge in coffee prices that took place in 2011. Starbucks also

hedges

its exposure to coffee prices, where at the end of the third quarter the company committed to purchasing green coffee for $557 million under fixed-price contracts and an estimated $297 million under price-to-be-fixed contracts.

Stacking up the competition

Notable competing coffee companies include Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR), Dunkin Brands Group Inc (NASDAQ:DNKN), Tim Hortons Inc. (USA) (NYSE:THI), and The J.M. Smucker Company (NYSE:SJM). Green Mountain is already up 7% year to date after releasing EPS numbers for last quarter that showed $0.76 of earnings per share, compared to $0.60 for the same quarter last year, and beating consensus estimates of $0.64. Billionaire David Einhorn said earlier this month that he’s still short the coffee maker (check out Einhorn’s stocks). This comes after Green Mountain upped its fiscal year 2013 guidance, and is now expecting to post EPS of $2.72 to $2.82 per share, compared to prior estimates of $2.64 to $2.74 per share.

Dunkin’s recent quarterly results were also up year over year, posting EPS of $0.34, compared to $0.30 for the same quarter last year, and compared to consensus of $0.33. The Dunkin story is compelling given that it remains a growth story. The company has opportunities for expansion in the western U.S. and internationally, with plans to open over 700 stores in 2013.

Tim Hortons Inc. (USA) (NYSE:THI) is the quick service coffee shop with a strong presence in Canada. Revenues were up 10% last quarter thanks to expansion efforts, and same store sale growth; 1.9% in Canada and 2.3% in U.S. Smucker is a lesser known company with vast exposure to the coffee markets. In fact Smucker derived almost 50% of its revenue from coffee in 2012. The stock pays a 2.3% dividend yield, but Goldman Sachs recently downgraded the company’s stock price to $93, essentially meaning that the stock trades near fair value.

Digging into what makes Starbucks’ a great buy

The outlook for Starbucks is impressive. The company expects revenues to grow between 10% and 13% in 2013, driven by strong comp sales. It’s not just in-store sales that are driving Starbucks growth, but also its CPG business, which includes packaged coffee and k-cups. This segment helps diversify revenues, and has higher margins.

U.S. and the Americas segment is the coffee company’s largest business and makes up nearly 65% of net revenues, but the future lies outside of America. The growth profile includes expectations to open 1300 stores next year, representing a 22% increase from fiscal 2012. Of the 1300 stores, 600 are planned for Asia, and over half of those will be in China. The Asia region has produced strong double-digit comps for eleven consecutive quarters, and management believes its China business will become thecompany’ssecond-largest market by 2014.

The balance sheet, including its cash position, has been strengthening of late. Starbucks’ has built up over $2 billion in cash on hand:

On the other hand, the coffee makers debt to equity ratio has been improving (declining), over the same time period that Starbucks has been building cash:

Don’t be fooled

From a valuation prospective, Starbucks appears somewhat expensive, trading at 30x earnings, which is at the high end of its five-year trading range from 12x to 35x. Even despite the valuation, Starbucks is the leader in the coffee market. The five year expected EPS growth (Wall Street estimates) comes in at 20%. The coffee company also pays a solid dividend that has room to grow. Stacking up the expected earnings and assumed dividend growth (30%), the pro forma payout stacks up as follows:

| 2011 | 2012 | 2013E | 2014E | |

| Earnings Per Share | $ 1.52 | $ 1.79 | $ 2.16 | $ 2.62 |

| Dividends Per Share | $ 0.68 | $ 0.84 | $ 1.09 | $ 1.42 |

| Payout | 45% | 47% | 51% | 54% |

Even if the stock doesn’t appreciate at all from current levels, if investors merely collect the pro forma dividends above the total return over the next twenty months would be around 4.5%; not too bad. However, I believe that the stock will appreciate thanks to its leading market position.

The article Is Starbucks Still A Buy? originally appeared on Fool.com and is written by Marshall Hargrave.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.