With the fourth-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter of 2021. One of these stocks was SS&C Technologies Holdings, Inc. (NASDAQ:SSNC).

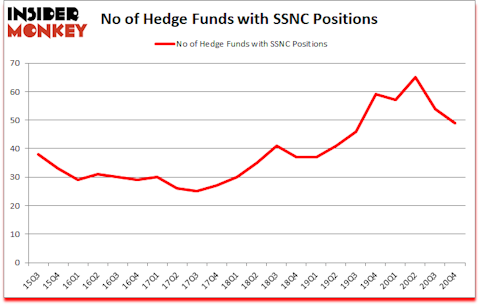

Is SSNC stock a buy or sell? Money managers were in a pessimistic mood. The number of bullish hedge fund bets decreased by 5 lately. SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) was in 49 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 65. Our calculations also showed that SSNC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 54 hedge funds in our database with SSNC positions at the end of the third quarter.

At the moment there are a multitude of signals stock market investors can use to appraise their stock investments. Some of the most useful signals are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can trounce the broader indices by a very impressive amount (see the details here).

William Von Mueffling of Cantillon Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). With all of this in mind we’re going to go over the new hedge fund action encompassing SS&C Technologies Holdings, Inc. (NASDAQ:SSNC).

Do Hedge Funds Think SSNC Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from one quarter earlier. On the other hand, there were a total of 59 hedge funds with a bullish position in SSNC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the number one position in SS&C Technologies Holdings, Inc. (NASDAQ:SSNC). Select Equity Group has a $820.9 million position in the stock, comprising 3.4% of its 13F portfolio. Sitting at the No. 2 spot is Alkeon Capital Management, managed by Panayotis Takis Sparaggis, which holds a $349.9 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions consist of William von Mueffling’s Cantillon Capital Management, Seth Klarman’s Baupost Group and John Smith Clark’s Southpoint Capital Advisors. In terms of the portfolio weights assigned to each position Blacksheep Fund Management allocated the biggest weight to SS&C Technologies Holdings, Inc. (NASDAQ:SSNC), around 17.5% of its 13F portfolio. Guardian Point Capital is also relatively very bullish on the stock, earmarking 10.38 percent of its 13F equity portfolio to SSNC.

Since SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) has faced falling interest from the entirety of the hedge funds we track, we can see that there is a sect of funds that decided to sell off their full holdings heading into Q1. It’s worth mentioning that Alexander Captain’s Cat Rock Capital cut the biggest position of all the hedgies watched by Insider Monkey, totaling an estimated $72.5 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also said goodbye to its stock, about $18.1 million worth. These moves are important to note, as total hedge fund interest dropped by 5 funds heading into Q1.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) but similarly valued. We will take a look at Restaurant Brands International Inc (NYSE:QSR), Smith & Nephew plc (NYSE:SNN), Amcor plc (NYSE:AMCR), Ventas, Inc. (NYSE:VTR), Xylem Inc (NYSE:XYL), DraftKings Inc. (NASDAQ:DKNG), and Dover Corporation (NYSE:DOV). This group of stocks’ market caps are similar to SSNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 39 | 2406995 | 6 |

| SNN | 12 | 78652 | 2 |

| AMCR | 19 | 247795 | 1 |

| VTR | 18 | 137388 | 1 |

| XYL | 21 | 725127 | 0 |

| DKNG | 48 | 399067 | 5 |

| DOV | 32 | 738937 | -8 |

| Average | 27 | 676280 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $676 million. That figure was $2624 million in SSNC’s case. DraftKings Inc. (NASDAQ:DKNG) is the most popular stock in this table. On the other hand Smith & Nephew plc (NYSE:SNN) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) is more popular among hedge funds. Our overall hedge fund sentiment score for SSNC is 72.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Unfortunately SSNC wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on SSNC were disappointed as the stock returned -4.4% since the end of the fourth quarter (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Ss&C Technologies Holdings Inc (NASDAQ:SSNC)

Follow Ss&C Technologies Holdings Inc (NASDAQ:SSNC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.