Is Southwestern Energy Company (NYSE:SWN) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

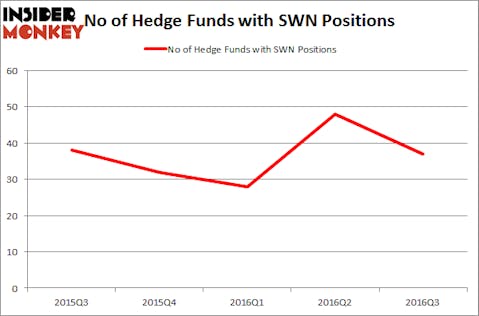

Southwestern Energy Company (NYSE:SWN) was in 37 hedge funds’ portfolios at the end of September. SWN has seen a decrease in support from the world’s most elite money managers of late. There were 48 hedge funds in our database with SWN positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as TFS Financial Corporation (NASDAQ:TFSL), Marvell Technology Group Ltd. (NASDAQ:MRVL), and SVB Financial Group (NASDAQ:SIVB) to gather more data points.

Follow Southwestern Energy Co (NYSE:SWN)

Follow Southwestern Energy Co (NYSE:SWN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

PLRANG ART/Shutterstock.com

With all of this in mind, let’s go over the new action regarding Southwestern Energy Company (NYSE:SWN).

What does the smart money think about Southwestern Energy Company (NYSE:SWN)?

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a plunge of 23% from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Andreas Halvorsen’s Viking Global has the largest position in Southwestern Energy Company (NYSE:SWN), worth close to $584.9 million, amounting to 2.5% of its total 13F portfolio. The second most bullish fund manager is Senator Investment Group, led by Doug Silverman and Alexander Klabin, holding a $121.1 million position; 1.6% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions comprise John Griffin’s Blue Ridge Capital, D. E. Shaw’s D E Shaw and Zach Schreiber’s Point State Capital.