The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Sonus Networks, Inc. (NASDAQ:SONS).

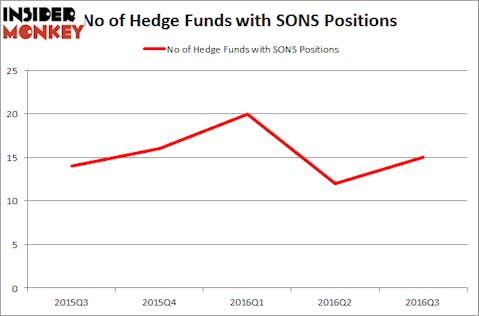

Sonus Networks, Inc. (NASDAQ:SONS) has seen an increase in enthusiasm from smart money lately. SONS was in 15 hedge funds’ portfolios at the end of the third quarter of 2016. There were 12 hedge funds in our database with SONS positions at the end of the previous quarter. At the end of this article we will also compare SONS to other stocks including Exactech, Inc. (NASDAQ:EXAC), IES Holdings Inc (NASDAQ:IESC), and OMNOVA Solutions Inc. (NYSE:OMN) to get a better sense of its popularity.

Follow Sonus Inc. (NASDAQ:SONS)

Follow Sonus Inc. (NASDAQ:SONS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

cherezoff / shutterstock.com

What does the smart money think about Sonus Networks, Inc. (NASDAQ:SONS)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a rise of 25% from the second quarter of 2016, following a steep drop off in Q2. The graph below displays the number of hedge funds with bullish position in SONS over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the number one position in Sonus Networks, Inc. (NASDAQ:SONS), worth close to $14.8 million. Sitting at the No. 2 spot is D E Shaw, founded by David E. Shaw, holding a $7.6 million position. Some other professional money managers that are bullish encompass Cliff Asness’ AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.