Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of Synopsys, Inc. (NASDAQ:SNPS) based on that data.

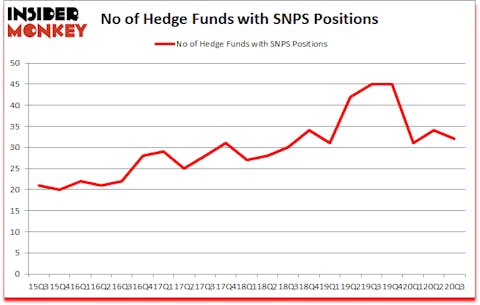

Is SNPS a good stock to buy? Synopsys, Inc. (NASDAQ:SNPS) was in 32 hedge funds’ portfolios at the end of September. The all time high for this statistic is 45. SNPS has seen a decrease in hedge fund sentiment in recent months. There were 34 hedge funds in our database with SNPS holdings at the end of June. Our calculations also showed that SNPS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are seen as unimportant, outdated financial vehicles of the past. While there are more than 8000 funds with their doors open today, We hone in on the top tier of this group, approximately 850 funds. These investment experts direct the lion’s share of the smart money’s total asset base, and by shadowing their finest picks, Insider Monkey has uncovered various investment strategies that have historically beaten the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update.

Andrew Sandler of Sandler Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a glance at the recent hedge fund action surrounding Synopsys, Inc. (NASDAQ:SNPS).

Do Hedge Funds Think SNPS Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNPS over the last 21 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Synopsys, Inc. (NASDAQ:SNPS) was held by Alkeon Capital Management, which reported holding $575.6 million worth of stock at the end of September. It was followed by Newbrook Capital Advisors with a $85 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and GLG Partners. In terms of the portfolio weights assigned to each position Crestwood Capital Management allocated the biggest weight to Synopsys, Inc. (NASDAQ:SNPS), around 6.58% of its 13F portfolio. Newbrook Capital Advisors is also relatively very bullish on the stock, earmarking 5.91 percent of its 13F equity portfolio to SNPS.

Due to the fact that Synopsys, Inc. (NASDAQ:SNPS) has faced a decline in interest from hedge fund managers, it’s safe to say that there was a specific group of funds who were dropping their positions entirely last quarter. At the top of the heap, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $14.6 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund cut about $2.9 million worth. These moves are interesting, as total hedge fund interest fell by 2 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Synopsys, Inc. (NASDAQ:SNPS). We will take a look at Mizuho Financial Group Inc. (NYSE:MFG), Amphenol Corporation (NYSE:APH), TE Connectivity Ltd. (NYSE:TEL), SYSCO Corporation (NYSE:SYY), Cummins Inc. (NYSE:CMI), IHS Markit Ltd. (NASDAQ:INFO), and Walgreens Boots Alliance Inc (NASDAQ:WBA). All of these stocks’ market caps are closest to SNPS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFG | 5 | 12057 | -3 |

| APH | 49 | 1163214 | 7 |

| TEL | 33 | 2008750 | -6 |

| SYY | 33 | 2199383 | -9 |

| CMI | 49 | 673230 | 11 |

| INFO | 44 | 1283750 | 0 |

| WBA | 33 | 285947 | -12 |

| Average | 35.1 | 1089476 | -1.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.1 hedge funds with bullish positions and the average amount invested in these stocks was $1089 million. That figure was $1059 million in SNPS’s case. Amphenol Corporation (NYSE:APH) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (NYSE:MFG) is the least popular one with only 5 bullish hedge fund positions. Synopsys, Inc. (NASDAQ:SNPS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SNPS is 55. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and still beat the market by 16.4 percentage points. A small number of hedge funds were also right about betting on SNPS as the stock returned 19.2% since the end of the third quarter (through 12/18) and outperformed the market by an even larger margin.

Follow Synopsys Inc (NASDAQ:SNPS)

Follow Synopsys Inc (NASDAQ:SNPS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.