After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31st. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX).

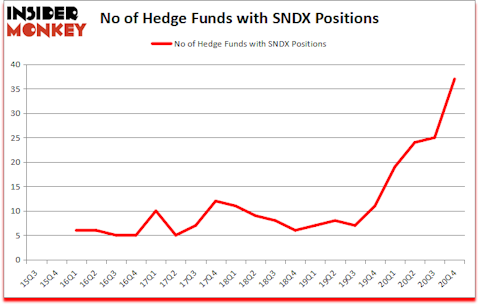

Is SNDX stock a buy? Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX) investors should pay attention to an increase in enthusiasm from smart money recently. Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX) was in 37 hedge funds’ portfolios at the end of December. The all time high for this statistic waspreviously 25. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 25 hedge funds in our database with SNDX holdings at the end of September. Our calculations also showed that SNDX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Phillip Gross of Adage Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s check out the key hedge fund action regarding Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX).

Do Hedge Funds Think SNDX Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 48% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SNDX over the last 22 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX) was held by Citadel Investment Group, which reported holding $47 million worth of stock at the end of December. It was followed by Adage Capital Management with a $40.7 million position. Other investors bullish on the company included Nantahala Capital Management, Frazier Healthcare Partners, and Ghost Tree Capital. In terms of the portfolio weights assigned to each position Ghost Tree Capital allocated the biggest weight to Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX), around 6.69% of its 13F portfolio. Commodore Capital is also relatively very bullish on the stock, dishing out 3.99 percent of its 13F equity portfolio to SNDX.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Avoro Capital Advisors (venBio Select Advisor), managed by Behzad Aghazadeh, initiated the largest position in Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX). Avoro Capital Advisors (venBio Select Advisor) had $10 million invested in the company at the end of the quarter. Eli Casdin’s Casdin Capital also initiated a $10 million position during the quarter. The other funds with brand new SNDX positions are Egen Atkinson and Michael Kramarz’s Commodore Capital, Joseph Edelman’s Perceptive Advisors, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX) but similarly valued. We will take a look at GenMark Diagnostics, Inc (NASDAQ:GNMK), Morphic Holding, Inc. (NASDAQ:MORF), Mission Produce, Inc. (NASDAQ:AVO), NV5 Global Inc (NASDAQ:NVEE), Arcos Dorados Holdings Inc. (NYSE:ARCO), Celestica Inc. (NYSE:CLS), and NextPoint Residential Trust Inc (NYSE:NXRT). This group of stocks’ market valuations are closest to SNDX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNMK | 21 | 246030 | -4 |

| MORF | 15 | 170634 | 7 |

| AVO | 7 | 27254 | 7 |

| NVEE | 10 | 26134 | 1 |

| ARCO | 12 | 54306 | 0 |

| CLS | 13 | 119478 | -2 |

| NXRT | 10 | 54714 | 1 |

| Average | 12.6 | 99793 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.6 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $472 million in SNDX’s case. GenMark Diagnostics, Inc (NASDAQ:GNMK) is the most popular stock in this table. On the other hand Mission Produce, Inc. (NASDAQ:AVO) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX) is more popular among hedge funds. Our overall hedge fund sentiment score for SNDX is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7.9% in 2021 through April 1st and still beat the market by 0.4 percentage points. Unfortunately SNDX wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on SNDX were disappointed as the stock returned 6.9% since the end of the fourth quarter (through 4/1) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Syndax Pharmaceuticals Inc (NASDAQ:SNDX)

Follow Syndax Pharmaceuticals Inc (NASDAQ:SNDX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.