Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 34.7% compared to 26.2%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

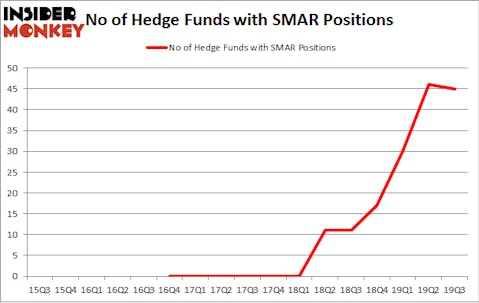

Is Smartsheet Inc. (NYSE:SMAR) a buy here? Hedge funds are taking a pessimistic view at the margin. The number of bullish hedge fund positions went down by 1 recently. Our calculations also showed that SMAR isn’t among the 30 most popular stocks among hedge funds. SMAR was in 45 hedge funds’ portfolios at the end of September. There were 46 hedge funds (all time high) in our database with SMAR holdings at the end of the previous quarter.

To most investors, hedge funds are seen as unimportant, old financial tools of the past. While there are greater than 8000 funds trading today, Our experts choose to focus on the upper echelon of this group, approximately 750 funds. It is estimated that this group of investors oversee most of the hedge fund industry’s total asset base, and by shadowing their highest performing stock picks, Insider Monkey has figured out many investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Chase Coleman of Tiger Global

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s review the fresh hedge fund action surrounding Smartsheet Inc. (NYSE:SMAR).

Hedge fund activity in Smartsheet Inc. (NYSE:SMAR)

At Q3’s end, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -2% from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in SMAR a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Whale Rock Capital Management was the largest shareholder of Smartsheet Inc. (NYSE:SMAR), with a stake worth $201.6 million reported as of the end of September. Trailing Whale Rock Capital Management was Tiger Global Management, which amassed a stake valued at $159.2 million. 12 West Capital Management, Abdiel Capital Advisors, and Alkeon Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position ThornTree Capital Partners allocated the biggest weight to Smartsheet Inc. (NYSE:SMAR), around 8.47% of its portfolio. 12 West Capital Management is also relatively very bullish on the stock, dishing out 7.73 percent of its 13F equity portfolio to SMAR.

Since Smartsheet Inc. (NYSE:SMAR) has witnessed bearish sentiment from the smart money, we can see that there was a specific group of hedge funds that decided to sell off their full holdings by the end of the third quarter. It’s worth mentioning that Glen Kacher’s Light Street Capital dropped the largest position of all the hedgies monitored by Insider Monkey, totaling about $53.1 million in stock, and Brian Ashford-Russell and Tim Woolley’s Polar Capital was right behind this move, as the fund said goodbye to about $37.9 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Smartsheet Inc. (NYSE:SMAR) but similarly valued. We will take a look at Equity Commonwealth (NYSE:EQC), Copa Holdings, S.A. (NYSE:CPA), RLI Corp. (NYSE:RLI), and PNM Resources, Inc. (NYSE:PNM). This group of stocks’ market caps are similar to SMAR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQC | 24 | 179039 | 4 |

| CPA | 18 | 284351 | 2 |

| RLI | 14 | 184377 | -1 |

| PNM | 14 | 413235 | 1 |

| Average | 17.5 | 265251 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $265 million. That figure was $1214 million in SMAR’s case. Equity Commonwealth (NYSE:EQC) is the most popular stock in this table. On the other hand RLI Corp. (NYSE:RLI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Smartsheet Inc. (NYSE:SMAR) is way more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on SMAR as the stock returned 24.2% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.