We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Smartsheet Inc. (NYSE:SMAR) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

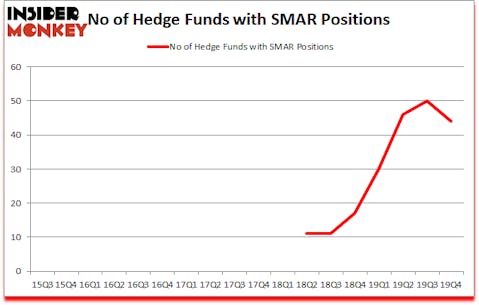

Smartsheet Inc. (NYSE:SMAR) investors should be aware of a decrease in support from the world’s most elite money managers of late. Our calculations also showed that SMAR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In today’s marketplace there are tons of metrics stock market investors employ to grade their stock investments. Some of the most under-the-radar metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace the S&P 500 by a superb amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to analyze the key hedge fund action encompassing Smartsheet Inc. (NYSE:SMAR).

What does smart money think about Smartsheet Inc. (NYSE:SMAR)?

Heading into the first quarter of 2020, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in SMAR a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Whale Rock Capital Management held the most valuable stake in Smartsheet Inc. (NYSE:SMAR), which was worth $251.2 million at the end of the third quarter. On the second spot was Coatue Management which amassed $243.8 million worth of shares. Tiger Global Management LLC, 12 West Capital Management, and Abdiel Capital Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 12 West Capital Management allocated the biggest weight to Smartsheet Inc. (NYSE:SMAR), around 12.57% of its 13F portfolio. Cota Capital is also relatively very bullish on the stock, designating 10.96 percent of its 13F equity portfolio to SMAR.

Since Smartsheet Inc. (NYSE:SMAR) has witnessed falling interest from the aggregate hedge fund industry, we can see that there was a specific group of hedge funds that slashed their full holdings by the end of the third quarter. Intriguingly, Edmond M. Safra’s EMS Capital said goodbye to the largest investment of all the hedgies watched by Insider Monkey, valued at close to $31.3 million in stock, and Lone Pine Capital was right behind this move, as the fund sold off about $18.2 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 6 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Smartsheet Inc. (NYSE:SMAR). We will take a look at First Industrial Realty Trust, Inc. (NYSE:FR), Macy’s, Inc. (NYSE:M), Etsy Inc (NASDAQ:ETSY), and Healthequity Inc (NASDAQ:HQY). This group of stocks’ market valuations are similar to SMAR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FR | 19 | 204822 | 2 |

| M | 32 | 861446 | 0 |

| ETSY | 46 | 814287 | -3 |

| HQY | 23 | 163737 | 1 |

| Average | 30 | 511073 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $511 million. That figure was $1653 million in SMAR’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand First Industrial Realty Trust, Inc. (NYSE:FR) is the least popular one with only 19 bullish hedge fund positions. Smartsheet Inc. (NYSE:SMAR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but still beat the market by 5.5 percentage points. Hedge funds were also right about betting on SMAR as the stock returned -3.5% during the first quarter (through March 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.