In this article we will analyze whether Skyline Champion Corporation (NYSE:SKY) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

Is SKY stock a buy? Hedge fund interest in Skyline Champion Corporation (NYSE:SKY) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that SKY isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as CSW Industrials, Inc. (NASDAQ:CSWI), Aurinia Pharmaceuticals Inc (NASDAQ:AUPH), and Otter Tail Corporation (NASDAQ:OTTR) to gather more data points.

In the eyes of most investors, hedge funds are perceived as underperforming, old investment tools of years past. While there are greater than 8000 funds with their doors open at the moment, Our experts hone in on the moguls of this club, around 850 funds. These investment experts direct most of all hedge funds’ total capital, and by paying attention to their matchless equity investments, Insider Monkey has unearthed a number of investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Richard Driehaus of Driehaus Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to review the key hedge fund action encompassing Skyline Champion Corporation (NYSE:SKY).

Do Hedge Funds Think SKY Is A Good Stock To Buy Now?

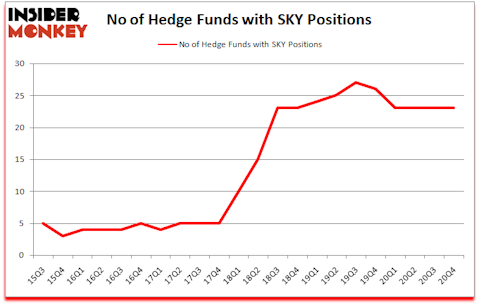

At the end of December, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the third quarter of 2020. Below, you can check out the change in hedge fund sentiment towards SKY over the last 22 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, MAK Capital One was the largest shareholder of Skyline Champion Corporation (NYSE:SKY), with a stake worth $104.2 million reported as of the end of December. Trailing MAK Capital One was Adage Capital Management, which amassed a stake valued at $28.3 million. Royce & Associates, SG Capital Management, and Driehaus Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position MAK Capital One allocated the biggest weight to Skyline Champion Corporation (NYSE:SKY), around 27.93% of its 13F portfolio. SG Capital Management is also relatively very bullish on the stock, earmarking 4.48 percent of its 13F equity portfolio to SKY.

Seeing as Skyline Champion Corporation (NYSE:SKY) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of money managers that elected to cut their positions entirely last quarter. At the top of the heap, James Dondero’s Highland Capital Management cut the largest investment of the 750 funds followed by Insider Monkey, valued at about $5.2 million in stock. Donald Sussman’s fund, Paloma Partners, also dumped its stock, about $0.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Skyline Champion Corporation (NYSE:SKY). We will take a look at CSW Industrials, Inc. (NASDAQ:CSWI), Aurinia Pharmaceuticals Inc (NASDAQ:AUPH), Otter Tail Corporation (NASDAQ:OTTR), Arbor Realty Trust, Inc. (NYSE:ABR), Prestige Consumer Healthcare Inc. (NYSE:PBH), Domtar Corporation (NYSE:UFS), and Two Harbors Investment Corp (NYSE:TWO). This group of stocks’ market caps resemble SKY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSWI | 13 | 37686 | -3 |

| AUPH | 24 | 336932 | -8 |

| OTTR | 9 | 57865 | -1 |

| ABR | 14 | 68492 | 3 |

| PBH | 14 | 94118 | -3 |

| UFS | 25 | 252958 | 1 |

| TWO | 18 | 58089 | 1 |

| Average | 16.7 | 129449 | -1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.7 hedge funds with bullish positions and the average amount invested in these stocks was $129 million. That figure was $237 million in SKY’s case. Domtar Corporation (NYSE:UFS) is the most popular stock in this table. On the other hand Otter Tail Corporation (NASDAQ:OTTR) is the least popular one with only 9 bullish hedge fund positions. Skyline Champion Corporation (NYSE:SKY) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SKY is 74.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Hedge funds were also right about betting on SKY as the stock returned 47.5% since the end of Q4 (through 4/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Champion Homes Inc. (NYSE:SKY)

Follow Champion Homes Inc. (NYSE:SKY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.