“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

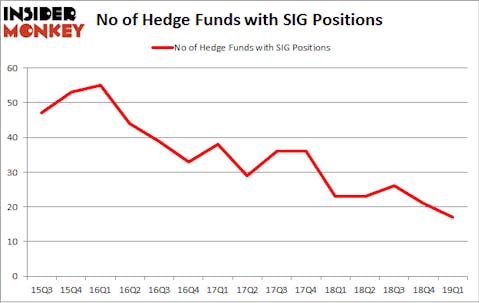

Signet Jewelers Limited (NYSE:SIG) was in 17 hedge funds’ portfolios at the end of March. SIG investors should pay attention to a decrease in hedge fund interest lately. There were 21 hedge funds in our database with SIG positions at the end of the previous quarter. Our calculations also showed that sig isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action surrounding Signet Jewelers Limited (NYSE:SIG).

How are hedge funds trading Signet Jewelers Limited (NYSE:SIG)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in SIG a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Lee Ainslie’s Maverick Capital has the biggest position in Signet Jewelers Limited (NYSE:SIG), worth close to $28.5 million, corresponding to 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Robert Joseph Caruso of Select Equity Group, with a $27.4 million call position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Cliff Asness’s AQR Capital Management, D. E. Shaw’s D E Shaw and Dmitry Balyasny’s Balyasny Asset Management.

Seeing as Signet Jewelers Limited (NYSE:SIG) has faced falling interest from hedge fund managers, logic holds that there is a sect of fund managers that elected to cut their full holdings heading into Q3. It’s worth mentioning that William B. Gray’s Orbis Investment Management dumped the biggest position of all the hedgies followed by Insider Monkey, valued at about $137.4 million in stock. Israel Englander’s fund, Millennium Management, also dropped its stock, about $6.2 million worth. These moves are important to note, as total hedge fund interest fell by 4 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Signet Jewelers Limited (NYSE:SIG) but similarly valued. These stocks are PennyMac Mortgage Investment Trust (NYSE:PMT), eHealth, Inc. (NASDAQ:EHTH), GreenTree Hospitality Group Ltd. (NYSE:GHG), and Grupo Simec S.A.B. de C.V. (NYSE:SIM). This group of stocks’ market values match SIG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PMT | 17 | 51537 | 6 |

| EHTH | 23 | 399035 | 4 |

| GHG | 9 | 33875 | 2 |

| SIM | 2 | 2259 | 1 |

| Average | 12.75 | 121677 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $122 million. That figure was $119 million in SIG’s case. eHealth, Inc. (NASDAQ:EHTH) is the most popular stock in this table. On the other hand Grupo Simec S.A.B. de C.V. (NYSE:SIM) is the least popular one with only 2 bullish hedge fund positions. Signet Jewelers Limited (NYSE:SIG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SIG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SIG were disappointed as the stock returned -34.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.