At Insider Monkey we follow around 740 of the top investors and even though many of them underperformed the raging bull market, the history teaches us that over the long-run they still manage to beat the market after adjusting for risk, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following their best picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

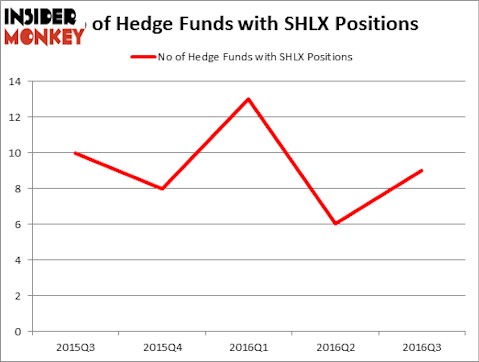

Is Shell Midstream Partners LP (NYSE:SHLX) worth your attention right now? Hedge funds are surely turning bullish. The number of long hedge fund investments increased by 3 lately. SHLX was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. There were 6 hedge funds in our database with SHLX holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Old Dominion Freight Line (NASDAQ:ODFL), CF Industries Holdings, Inc. (NYSE:CF), and Vail Resorts, Inc. (NYSE:MTN) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shutterstock.com

What does the smart money think about Shell Midstream Partners LP (NYSE:SHLX)?

At the end of the third quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, up by 50% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SHLX over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Stuart J. Zimmer’s Zimmer Partners holds the most valuable position in Shell Midstream Partners LP (NYSE:SHLX). Zimmer Partners has a $22 million position in the stock. Coming in second is Renaissance Technologies, one of the largest hedge funds in the world; with a $11.1 million position. Some other peers that hold long positions encompass James Dondero’s Highland Capital Management, Richard Driehaus’ Driehaus Capital and Dmitry Balyasny’s Balyasny Asset Management. We should note that Zimmer Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were breaking ground themselves. Driehaus Capital, created the largest position in Shell Midstream Partners LP (NYSE:SHLX). Driehaus Capital had $3.2 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.7 million position during the quarter. The following funds were also among the new SHLX investors: Israel Englander’s Millennium Management and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Shell Midstream Partners LP (NYSE:SHLX) but similarly valued. We will take a look at Old Dominion Freight Line (NASDAQ:ODFL), CF Industries Holdings, Inc. (NYSE:CF), Vail Resorts, Inc. (NYSE:MTN), and VCA Antech Inc (NASDAQ:WOOF). This group of stocks’ market values are closest to SHLX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ODFL | 14 | 67609 | -10 |

| CF | 38 | 1022137 | 4 |

| MTN | 35 | 497137 | 2 |

| WOOF | 34 | 478539 | 4 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $516 million. That figure was $47 million in SHLX’s case. CF Industries Holdings, Inc. (NYSE:CF) is the most popular stock in this table. On the other hand Old Dominion Freight Line (NASDAQ:ODFL) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Shell Midstream Partners LP (NYSE:SHLX) is even less popular than ODFL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None