Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 835 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about ServiceNow Inc (NYSE:NOW).

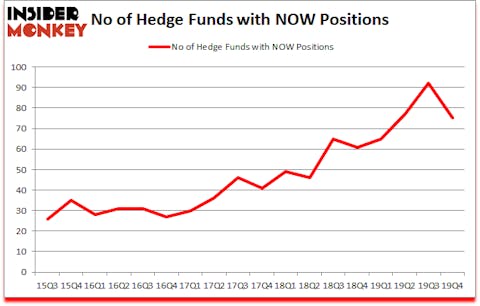

ServiceNow Inc (NYSE:NOW) has experienced a decrease in support from the world’s most elite money managers lately. Our calculations also showed that NOW isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are tons of gauges stock market investors use to evaluate their stock investments. A pair of the less known gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the broader indices by a very impressive margin (see the details here).

Andreas Halvorsen of Viking Global

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind we’re going to take a look at the key hedge fund action encompassing ServiceNow Inc (NYSE:NOW).

How have hedgies been trading ServiceNow Inc (NYSE:NOW)?

Heading into the first quarter of 2020, a total of 75 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NOW over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Andreas Halvorsen’s Viking Global has the number one position in ServiceNow Inc (NYSE:NOW), worth close to $777.4 million, amounting to 3.6% of its total 13F portfolio. Sitting at the No. 2 spot is Coatue Management, led by Philippe Laffont, holding a $772.6 million position; 6.1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions encompass Lone Pine Capital, Gabriel Plotkin’s Melvin Capital Management and Daniel Sundheim’s D1 Capital Partners. In terms of the portfolio weights assigned to each position Praesidium Investment Management Company allocated the biggest weight to ServiceNow Inc (NYSE:NOW), around 11.72% of its 13F portfolio. North Peak Capital is also relatively very bullish on the stock, dishing out 11.41 percent of its 13F equity portfolio to NOW.

Due to the fact that ServiceNow Inc (NYSE:NOW) has faced declining sentiment from the smart money, it’s easy to see that there exists a select few money managers who sold off their full holdings in the third quarter. At the top of the heap, Panayotis Takis Sparaggis’s Alkeon Capital Management sold off the largest investment of all the hedgies followed by Insider Monkey, valued at about $317.3 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dumped its stock, about $213.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 17 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to ServiceNow Inc (NYSE:NOW). These stocks are General Motors Company (NYSE:GM), Las Vegas Sands Corp. (NYSE:LVS), America Movil SAB de CV (NYSE:AMX), and Walgreens Boots Alliance Inc (NASDAQ:WBA). All of these stocks’ market caps match NOW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GM | 75 | 6531524 | -1 |

| LVS | 37 | 1256467 | -5 |

| AMX | 17 | 278371 | 6 |

| WBA | 38 | 693507 | 0 |

| Average | 41.75 | 2189967 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.75 hedge funds with bullish positions and the average amount invested in these stocks was $2190 million. That figure was $5035 million in NOW’s case. General Motors Company (NYSE:GM) is the most popular stock in this table. On the other hand America Movil SAB de CV (NYSE:AMX) is the least popular one with only 17 bullish hedge fund positions. ServiceNow Inc (NYSE:NOW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on NOW as the stock returned 22% during the first quarter (through March 2nd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.