During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Seritage Growth Properties (NYSE:SRG) and see how the stock is affected by the recent hedge fund activity.

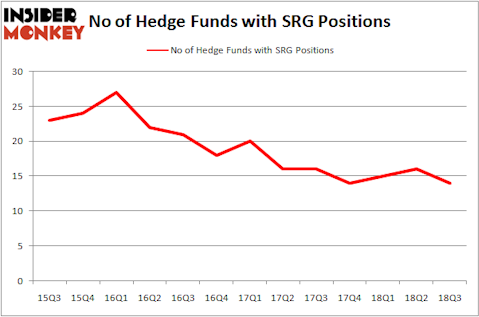

Seritage Growth Properties (NYSE:SRG) investors should be aware of a decrease in enthusiasm from smart money of late. Our calculations also showed that SRG isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to review the recent hedge fund action encompassing Seritage Growth Properties (NYSE:SRG).

How are hedge funds trading Seritage Growth Properties (NYSE:SRG)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SRG over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, BloombergSen, managed by Jonathan Bloomberg, holds the largest position in Seritage Growth Properties (NYSE:SRG). BloombergSen has a $118.4 million position in the stock, comprising 6.5% of its 13F portfolio. Coming in second is Empyrean Capital Partners, managed by Michael A. Price and Amos Meron, which holds a $89.9 million position; the fund has 2.8% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism comprise Edmond M. Safra’s EMS Capital, Isaac Corre’s Governors Lane and Jeffrey Gates’s Gates Capital Management.

Due to the fact that Seritage Growth Properties (NYSE:SRG) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedgies who sold off their positions entirely in the third quarter. Interestingly, Kelly Hampaul’s Everett Capital Advisors sold off the biggest investment of the 700 funds tracked by Insider Monkey, worth close to $14.4 million in call options. Kelly Hampaul’s fund, Everett Capital Advisors, also cut its call options, about $2.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Seritage Growth Properties (NYSE:SRG) but similarly valued. These stocks are Xenia Hotels & Resorts Inc (NYSE:XHR), Cabot Microelectronics Corporation (NASDAQ:CCMP), Dycom Industries, Inc. (NYSE:DY), and Acceleron Pharma Inc (NASDAQ:XLRN). This group of stocks’ market caps are closest to SRG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XHR | 9 | 103413 | -3 |

| CCMP | 19 | 301066 | 0 |

| DY | 23 | 212220 | -3 |

| XLRN | 27 | 441031 | 3 |

| Average | 19.5 | 264433 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $413 million in SRG’s case. Acceleron Pharma Inc (NASDAQ:XLRN) is the most popular stock in this table. On the other hand Xenia Hotels & Resorts Inc (NYSE:XHR) is the least popular one with only 9 bullish hedge fund positions. Seritage Growth Properties (NYSE:SRG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard XLRN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.