Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of SeaDrill Limited (NYSE:SDRL).

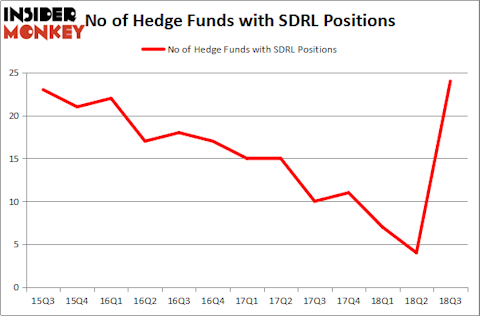

SeaDrill Limited (NYSE:SDRL) investors should be aware of an increase in enthusiasm from smart money recently. Our calculations also showed that SDRL isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the recent hedge fund action surrounding SeaDrill Limited (NYSE:SDRL).

Hedge fund activity in SeaDrill Limited (NYSE:SDRL)

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 500% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in SDRL at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Centerbridge Partners was the largest shareholder of SeaDrill Limited (NYSE:SDRL), with a stake worth $197.2 million reported as of the end of September. Trailing Centerbridge Partners was King Street Capital, which amassed a stake valued at $165 million. GLG Partners, Aristeia Capital, and Saba Capital were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Centerbridge Partners, managed by Mark T. Gallogly, assembled the most outsized position in SeaDrill Limited (NYSE:SDRL). Centerbridge Partners had $197.2 million invested in the company at the end of the quarter. Brian J. Higgins’s King Street Capital also initiated a $165 million position during the quarter. The other funds with brand new SDRL positions are Noam Gottesman’s GLG Partners, Robert Henry Lynch’s Aristeia Capital, and Boaz Weinstein’s Saba Capital.

Let’s go over hedge fund activity in other stocks similar to SeaDrill Limited (NYSE:SDRL). We will take a look at Brooks Automation, Inc. (NASDAQ:BRKS), DDR Corp (NYSE:DDR), PriceSmart, Inc. (NASDAQ:PSMT), and Beacon Roofing Supply, Inc. (NASDAQ:BECN). This group of stocks’ market caps match SDRL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRKS | 12 | 139987 | 2 |

| DDR | 12 | 136063 | -3 |

| PSMT | 9 | 36325 | 5 |

| BECN | 21 | 382408 | -4 |

| Average | 13.5 | 173696 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $174 million. That figure was $838 million in SDRL’s case. Beacon Roofing Supply, Inc. (NASDAQ:BECN) is the most popular stock in this table. On the other hand PriceSmart, Inc. (NASDAQ:PSMT) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks SeaDrill Limited (NYSE:SDRL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.