Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Scotts Miracle-Gro Co (NYSE:SMG) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

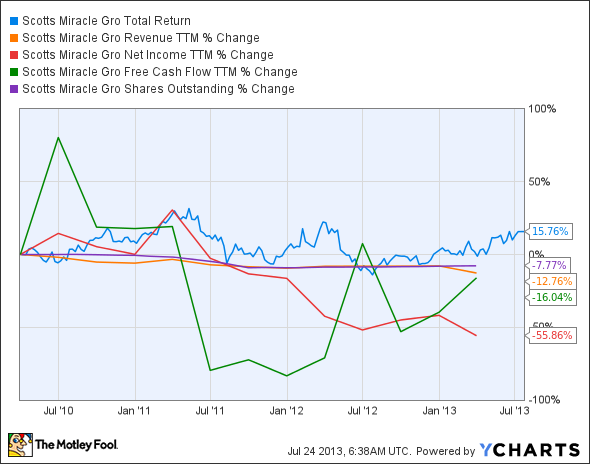

The graphs you’re about to see tell Scotts Miracle-Gro Co (NYSE:SMG)’ story, and we’ll be grading the quality of that story in several ways:

1). Growth: Are profits, margins, and free cash flow all increasing?

2). Valuation: Is share price growing in line with earnings per share?

3). Opportunities: Is return on equity increasing while debt to equity declines?

4). Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at Scotts’ key statistics:

SMG Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | (12.8%) | Fail |

| Improving profit margin | (49.4%) | Fail |

| Free cash flow growth > Net income growth | (16%) vs. (55.9%) | Pass |

| Improving EPS | (53.5%) | Fail |

| Stock growth (+ 15%) < EPS growth | 15.8% vs. (53.5%) | Fail |

Source: YCharts. * Period begins at end of Q1 2010.

SMG Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (57.9%) | Fail |

| Declining debt to equity | 8.7% | Fail |

| Dividend growth > 25% | 160% | Pass |

| Free cash flow payout ratio < 50% | 52.5% | Fail |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we’re going

Scotts Miracle-Gro Co (NYSE:SMG) wilts under the pressure today, earning only two out of nine possible passing grades — one of which was granted mainly due to a technicality. Despite this weakness, Scotts shares have hit new peaks since emerging from the crash of 2008. But how can Scotts keep outperforming in the future? Will these financial doldrums reverse, or is Scotts Miracle-Gro Co (NYSE:SMG)’s future looking a little bit too weedy? Let’s dig a little deeper.

Scotts Miracle-Gro’s management blamed colder weather, and a delayed start to the spring season, for the slump in sales, which resulted in a steep revenue miss in the second quarter. Despite major headwinds, the company experienced strong performance from non-weather-affected areas. Purchases in California were up 43%, exemplifying the overall sales performance seen on the West Coast. Consumer purchases were also up 19% year over year as the weather improved during the first month of the third quarter, leaving purchases down 9% year to date. However, the company acknowledged that there’s a chance that the shorter season will lead to some lost sales.

Net sales decreased by 5% over the past four quarters, while inventory increased by 2%. Work-in-progress inventory was the fastest-growing segment, and that rose by 11%. Although Scotts Miracle-Gro Co (NYSE:SMG) shows inventory growth that outpaces revenue growth, the company may also display positive inventory trends if we assume that management sees increased demand on the horizon.